How to interpret N(d1) and N(d2) in Black Scholes Merton (FRM T4-12)

Vložit

- čas přidán 20. 07. 2024

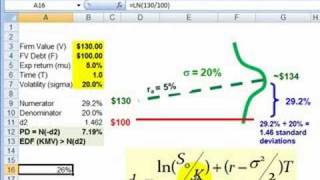

- (my xls is here trtl.bz/2E8qsmw) N(d1) is the option's delta and N(d2) is the probability that a call option will be exercised; that is, N(d2) is the probability that S(T) will be greater than K.

💡 Discuss this video here in the forum: trtl.bz/2Vw51kP

👉 Subscribe here / bionicturtl. .

to be notified of future tutorials on expert finance and data science, including the Financial Risk Manager (FRM), the Chartered Financial Analyst (CFA), and R Programming!

❓ If you have questions or want to discuss this video further, please visit our support forum (which has over 50,000 members) located at bionicturtle.com/forum

🐢 You can also register as a member of our site (for free!) at www.bionicturtle.com/register/

📧 Our email contact is support@bionicturtle.com (I can also be personally reached at davidh@bionicturtle.com)

For other videos in our Financial Risk Manager (FRM) series, visit these playlists:

Texas Instruments BA II+ Calculator

czcams.com/users/playlist?list...

Risk Foundations (FRM Topic 1)

czcams.com/users/playlist?list...

Quantitative Analysis (FRM Topic 2)

czcams.com/users/playlist?list...

Financial Markets and Products: Intro to Derivatives (FRM Topic 3, Hull Ch 1-7)

czcams.com/users/playlist?list...

Financial Markets and Products: Option Trading Strategies (FRM Topic 3, Hull Ch 10-12)

czcams.com/users/playlist?list...

FM&P: Intro to Derivatives: Exotic options (FRM Topic 3)

czcams.com/users/playlist?list...

Valuation and Risk Models (FRM Topic 4)

czcams.com/users/playlist?list...

Coming Soon ....

Market Risk (FRM Topic 5)

Credit Risk (FRM Topic 6)

Operational Risk (FRM Topic 7)

Investment Risk (FRM Topic 8)

Current Issues (FRM Topic 9)

For videos in our Chartered Financial Analyst (CFA) series, visit these playlists:

Chartered Financial Analyst (CFA) Level 1 Volume 1

czcams.com/users/playlist?list...

#bionicturtle #risk #financialriskmanager #FRM #finance #expertfinance

Our videos carefully comply with U.S. copyright law which we take seriously. Any third-party images used in this video honor their specific license agreements. We occasionally purchase images with our account under a royalty-free license at 123rf.com (see www.123rf.com/license.php); we also use free and purchased images from our account at canva.com (see about.canva.com/license-agree.... In particular, the new thumbnails are generated in canva.com. Please contact support@bionicturtle.com or davidh@bionicturtle.com if you have any questions, issues or concerns.

This was by far the best explanation of d1 and d2. Thank you

Thanks, this is a great explanation! Very helpful

Thank you so much! Your video helped me a lot!

this helped me on my journey to calculate my fathers monthly hair loss

Thank you so much professor! so helpful.

thank you sir! I liked your video very much.

That uploaded excel sheet was super great!! Thanks a lot!

Thank you for watching! We are happy to hear that it was so helpful.

Very good effort Sir

For the calculation of d1 and d2, does the So number in ln (So/k) change when dividend yield is introduced? In the GARP textbook it seems like it does not change for continuous dividend, but for discrete dividend they would replace So with (So - discounted discrete dividend).

When returns are not normally distributed could one simply replace the normal distribution with the alternative distribution or are additional changes required to the formula?

I love it that you have a gamer's channel name

amazing explanation

Thank you for watching!

Do you have any opinions on using delta as an approximation to probability of in the money?

awesome xplaination;;;;;

Is it ok to use a negative riskfree rate r in that model?

In the formula of d1 and d2 the part of (r + sd^2/2) T, what does that measures?

mean of the data

Which version of John Hull's book do you use for this example?

Nice

Can you explain what the terms inside of "d1" actually mean? I believe d1 is a Z-score of some type.

I recommend actually watching the video if you want to know what d1 means.

What is the sound of the cricket?

what a shame, the excel spreadsheet no longer exists!

Great explanation. I'm still a bit confused with N(d1), when you say the underwater price is counted as zero.

If I denote p1 = N(d1) and p2=N(d2), and forget assume q and r are both zero, is it true that Sp1 = (S-K)p2 + K ?

I believe N(d2) is the probability that the option will end in the money and N(d1) is how far in the money will it end up.

N(d1) is the conditional probability by assuming S>K and thus SN(d1) is the conditional expectation of S. Note that N(d1) would always bigger than N(d2) due to the conditional probabilities. Mathmatically, SN(d1) = E(S|S>K)*N(d2).

Should the stock be assumed to grow at the risk free rate or should the baseline be growth at cost of equity rate?

Stock grows at drift rate. Mu. Look it up.

what is dividend yield in black scholes used for? can i find dividend yield in financial report of company?

you can calculate dividend yield yourself. it's dividend per share/price of stock. When dividends are paid out it reduces the stock price by that amount (assuming no frictions). this topic is about price appreciation so we need to consider how dividend payments restrict capital appreciation

you can easily get it by: (cash dividend/current stock price) -> 10$/25$ = 40% DY. Dividend is usually a part of the profit that the company shares with its shareholders (approved during shareholder meeting)

Trang Huyen

: Many of the Black Scholes videos don't include the dividend in the formula.The dividend sometimes denoted by (q) is included to get a more accurate result for d1 in cases where there is a dividend.

if probability of option being exercised increases, the value of that option decreases.. that does not sound right, does it...(?)

if N(d1) is the option's delta, why don't we just refer to it as 'delta' in the BSM formula instead of confusing everybody?

Sometimes words alone are confusing, when you really want to understand something or are quantitatively inclined. As a normal CDF, it has familiar properties, some discussed; e.g., it is a probability function. But "delta" by itself, could be ambiguous. The put option's delta, for example, is N(d1) - 1. If the stock pays a dividend, then "delta" is N(d1)*exp(-qt). I realize some people just want easy words because, you know, math is hard, but under your approach, people are likely to confuse all "deltas" with N(d1), or if the stock pays a dividend, to forget the delta is N(d1)*exp(-qt). So your approach would be more confusing IMO.

I know you de-emphasized it in the sheet (denoted by the light grey font) but the "d2" formula is technically incorrect. The part on the far right "d1 - sigma * sqrt(T)" is correct, but the formula to the left of it should be "[formula that is already there] - sigma * sqrt(T)"

Actually the d1 and d2 are CORRECT. σ*sqrt(T) = σ^2*T/[σ*sqrt(T)], is how the (+σ^2/2) switches to a (-σ^2/2). But thanks for the feedback.