Utilizing the Low Income Housing Tax Credit (LIHTC): An Introduction

Vložit

- čas přidán 30. 07. 2024

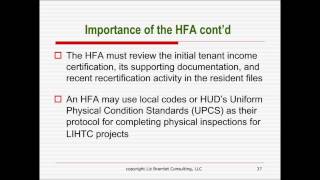

- The low‐income housing tax credit (LIHTC) program is one of the federal government's primary policy tools for encouraging the development and rehabilitation of affordable rental housing. While the LIHTC Program can seem complex; the program is being effectively utilized by numerous housing and community development agencies to increase affordable housing options available in their local communities. This webinar will provide a basic introduction to the LIHTC Program.

PowerPoint: Low Income Housing Tax Credits: An Introduction (.pdf) - ruralhome.org/storage/document...

Resources:

1. Low Income Housing Tax Credit Summary (.pdf)

www.hudexchange.info/resource...

2. Low Income Housing Tax Credit Fair Housing

portal.hud.gov/hudportal/HUD?s...

3. Liz Bramlet Consulting LLC

www.lizbramletconsulting.com/

Funded by: U.S. Department of Housing and Urban Development and U.S. Department of Agriculture - Rural Development

Thanks for providing this presentation. Very helpful.

thank u

This is wonderful! ARe you kay with me using these to teach a class on Affordable Housing?

Hi Jordan! We are so glad you found this material useful. Please feel free to use it as part of your class and please spread the word about the resource!

What do selected for low income tax credit mean

All they talk about is how to protect their tax credits. Wait until LIHTC tenants lose all rights...the investors get rich...andow income tenants are displaced. THIS IS A WOLF IN SHEEPS CLOTHING