IRS Form 15111 walkthrough (Earned Income Credit Worksheet/CP 09)

Vložit

- čas přidán 7. 09. 2024

- If you received an IRS CP 09 letter, you may have also received IRS Form 15111, Earned Income Credit Worksheet.

Complete this worksheet to determine whether you qualify for the earned income tax credit.

Here are links to articles and videos we've created about other tax forms and schedules mentioned in this video or its accompanying article:

How to Understand Your CP09 Notice (IRS Tax Credit - Earned Income Credit)

• How to Understand Your...

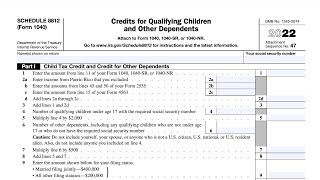

IRS Schedule EIC, Earned Income Tax Credit

Article: www.teachmeper...

Video: • Schedule EIC walkthrou...

Please feel free to check out our article, where we've written step by step instructions to help you walk through this tax form! www.teachmepersonalfinance.com/irs-form-15111-instructions/

I don’t understand why I got this form I didn’t claim no child this year can you explain which box should I mark thank you

You might be eligible for the EIC based on your income, even without a qualifying child.

I would not know which box you should check without knowing more about your situation, but watching the video might help you to understand what you should do. If you have specific questions after watching this video or reading the article, please post them here.

Where do you sign?

That's a good question, since the form does not appear to have a signature field on it. I would recommend that you complete the form to the best of your ability, then upload it using the IRS Documentation Upload Tool, if your notice came with an access code. That access code, along with the information that you provide, should suffice to verify your identity.

If your notice did not come with an access code, or if you cannot find it, then I would recommend that you contact the IRS to see what they recommend.

Hello there , I mistakenly added a child to the form , we have 3 children, I claimed 2 , my boyfriend claimed 1 , after I filed my tax , I received this form , so I didn’t even put it together that it has to match the return that I just done , plus I was thinking maybe this is something that an extra because if it is not I got it right on my return already why IRS still sent the form , so maybe I need to put all my children , I am merely educated on this .

So then IRS sent me a response saying that , my return and 15111 not match , if I wish to add another child , just go ahead amend the tax , well I can’t amend the tax , the extra child already claimed in my boyfriend tax , so I said how to fix it , they said because my information was wrong , so I sad how about my rightful right to claim 2 children , they said IRS also disallow them too, so now I could not claim for 2 children earn income credit.

Any suggestions that I could fix this ! 🙏

Without actually being able to see your tax return, your boyfriend's tax return, or the CP09 notice itself, I'm not sure that I could give you any useful guidance.

Below is a link to the IRS' Low Income Tax Clinic, which helps taxpayers resolve issues and concerns they have with the IRS, but who would otherwise not be able to hire a CPA or tax professional on their own. If you meet their income criteria (based on your income and where you live), then these might be the best people to sit down with you, help you understand exactly what the IRS is looking for, and take the right steps to address your CP09 notice.

www.taxpayeradvocate.irs.gov/about-us/low-income-taxpayer-clinics-litc/

@@teachmepersonalfinance2169 what would be my cost to have it looked over by you ?

@@sophiessimplecooking1209 Unfortunately, I'm not taking on clients at this time. I've got some inquiries out to a few tax folks to see whether they'd take on new clients, but I haven't really gotten a response yet.

Also, I'd be wary of big-box preparation firms who seem to profit off people claiming the EITC. Many smaller tax preparers don't like taking on this work, because there is a decent amount of work involved in documentation and fact-checking, due to the high amounts of fraudulent claims.

With that said, I do think that working directly with the IRS might be the best way to go. If you're not interested or eligible for the LITC, you may also consider the Taxpayer Advocate Service, which is an independent office within the IRS that helps taxpayers navigate tax problems: www.irs.gov/advocate/local-taxpayer-advocate

As a follow up, I do have one CPA colleague who might be interested. Can you send me an email with a brief recap of your situation to: forrest@teachmepersonalfinance.com? Once I receive your email, I'll forward it on to her.

@@teachmepersonalfinance2169 will do that , thank you !