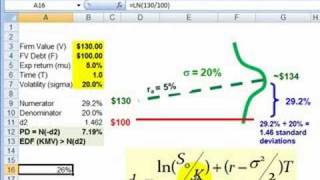

FRM: Expected default frequency (EDF, PD) with Merton Model

Vložit

- čas přidán 14. 10. 2024

- A visual and Excel-based review of the Merton model used to estimate EDF (or probability of default). This is a structural approach; i.e,. default is predicted by the firm's balance sheet properties. For more financial risk videos, visit our website! www.bionicturtl...

David I can't thank you enough for clarifying the concepts so easily :)

I have never seen this simple explanation of Merton's model. Please let me know if you have a tutorial on KMV model as well. Big thanks to you!

KMV is similar to this merton model only

Thanks for the video. Do you have any videos on how Moody's KMV does their calculation and how it compares to Bloomberg DRSK. I know that both use the Merton Model but their result of probability can be significant sometimes.

is tht 1184 a random value which we estimated it will be at that point?

You are the best, David! You just saved my tomorrow! Yippee!

very lucid. thanks!

I think I understand the model and I get all the right numbers...except, the last, wenn i put in excel norm.s.vert(-2.78; falsch) I get 0.0099168 ... can someone help me what i did wrong?

hey david,

I am writing because I have a fundamental question to ask. You assume that the assets are 1000 (so E+D), but in reality we only equity (share price x shares) and book liabilities. I wanted to know if maybe you can make a tutorial on how to apply option-pricing model (BS) to find the assets value and the standard deviation of the assets i am having problems doing this in excel

very useful

why is it half of the long term liability only?

Very good and informative video! Thanks

how he get the Default Point 600?

great video! thank you for the clear explanation abt this model. ive been looking for something like for quite some time. +1

You are not using the terminology commonly used in banking- PD, LGD, EAD.

am I crazy? but the formula showed (mean-sigma/2) but when he talked about it via the calculation he said it was the (mean - variance/2)

so is it the variance? or the sigma (std dev) as he divided by sigma*T.. and didnt have variance*T) maybe the sigma with a 2 in the bottom means sigma^2?

formula is asset growth or drift minus 1/2 times volatility squared. since vol sq is variance you can write is as:

mu - (.5)(variance)

this is the added cushion with passage of time.

You are not crazy. I think the mistake on the formula is where he has 2 on the denote rather than the exponent

In the numerator, you have the variance (SD^2), while in the denominator you have just SD. I guess he forgot to put the 2 as a power rather than a signifier at the bottom.

How was 1184 calculated? Thanks in advance!

exp(mu- variance*.5) ... the term in bracket is the added cushion with time and exponential of bracket will give the value after growth

I love you. Thaaaaaaanks a lot!

no scuh thing as riskx or nto, doesn tmatter

How do you say 1000/600 is 51% ?!

you have to remember Ln.

Thanks a lot!!

Gracias!!!!

You're welcome! Thank you for watching :)

fantastic as usual. any equation i need conceptualising = youtube David Harper

u rock 谢谢

IIMB!!!!