Option Sensitivity and The Greeks

Vložit

- čas přidán 5. 09. 2024

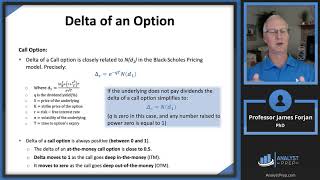

- This video introduces "The Greeks" (named after the greek alphabet letters that are used to refer to them) which measure (approximate) sensitivities to the underlying variables. Delta measures the sensitivity to the underlying stock price. Gamma measures how sensitive delta is to changes in the underlying stock price. Theta measures the sensitivity of the option to loss of time. Vega measures the sensitivity of the option to changes in the volatility of the underlying stock. Finally, Rho measures the sensitivity of the option to changes in the risk-free rate. Note that these are approximations as they are not truly linear relationships. Therefore, they work better for estimating the impact of small changes rather than large changes in the underlying variables.

Mr. Kevin, Informative video... thanks for sharing.....

thank you a lot do some more like binomial models and swaps