Income Tax Calculation on Salary Payslip | How to Calculate Income Tax [Calculator]

Vložit

- čas přidán 1. 06. 2024

- Income Tax Calculation on Salary Payslip | How to Calculate Income Tax [Calculator]

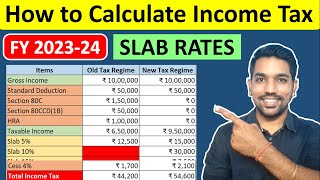

In this video by FinCalC TV we will see Income Tax Calculation on Salary using salary payslip in hindi. We will check old tax regime and new tax regime calculations with the help of income tax calculator and tax slab rates 2023-24. This will help you in income tax return filing as a salaried employee.

Income Tax Calculator Online:

fincalc-blog.in/income-tax-ca...

Income Tax Slabs 2023-24:

fincalc-blog.in/old-vs-new-ta...

New Tax Regime Deductions Allowed:

fincalc-blog.in/new-tax-slabs...

DOWNLOAD Income Tax Calculator App on Mobile:

play.google.com/store/apps/de...

JOIN Telegram Group:

t.me/fincalc_tv_channel

CHAPTERS:

00:00 Income Tax Calculation on Salary Intro

00:57 Salary Payslip Structure Example

03:19 Applying Deductions to Save Income Tax

05:20 Professional Tax in Salary

06:20 Taxable Income Calculation

07:31 Income Tax Slabs [Old Regime]

07:49 Calculating Tax based on Slab Rates

09:02 Tax Rebate 87A Eligibility

10:19 Income Tax Slabs [New Regime]

12:02 Example 2 for Income Tax Calculation on Salary

17:26 Using FinCalC Income Tax Calculator

20:32 Conclusion

HRA Calculation Video:

• HRA Calculation in Inc...

Tax Saving options with Old Tax Regime:

• SAVE Income Tax using ...

Section 80C Deductions List:

• Section 80C Deductions...

After watching this video following queries will be solved:

How To Calculate Income Tax FY 2023-24 AY 2024-25?

What are the income tax slab rates for FY 2023-24?

What is standard deduction for FY 2023-24?

Old Slab rates vs new slab rates?

Income Tax calculation FY 2023-24 using excel examples?

Tax rebate under section 87A?

What is tax rebate u/s 87a

Eligibility for tax rebate 87a

Old income tax slab rates calculation vs new income tax slab rates calculation

New Budget 2023 income tax

standard deduction new tax regime

NEW TAX REGIME:

- No Income Tax on Income between Rs. 0 to Rs. 3 lacs

- 5% Tax on Income between Rs. 3 lacs to Rs. 6 lacs

- 10% Tax on Income between Rs. 6 lacs to Rs. 9 lacs

- 15% Tax on Income between Rs. 9 lacs to Rs. 12 lacs

- 20% Tax on Income between Rs. 11 lacs to Rs. 15 lacs

- 30% Tax on Income above Rs. 15 lacs

OLD TAX REGIME:

- No Income Tax on Income between Rs. 0 to Rs. 2.5 lacs

- 5% Tax on Income between Rs. 2.5 lacs to Rs. 5 lacs

- 20% Tax on Income between Rs. 5 lacs to Rs. 10 lacs

- 30% Tax on Income above Rs. 10 lacs

EXAMPLES:

Let's say your gross total income as Rs. 6,15,000

Let's say your total investments as Rs. 75,000. So your net taxable income becomes equal to Rs. 6,15,000 minus Rs. 75,000, which is equal to Rs. 5,40,000. These Deductions are applicable only if you are using Old Tax slab rates. Your net taxable income when considering New Tax slab rates remains Rs. 6,15,000, as no deductions are applied on your total income.

Now to calculate your income tax, if you are an employee or pensioner, you get a standard deduction of Rs. 50,000 only if you are using old tax slab rates.

So your net taxable income becomes equal to Rs. 4,90,000 if you are using Old Tax Slab Rates. But it remains as Rs. 6,15,000 based on new Tax Slab rates.

WATCH FULL VIDEO TO KNOW MORE ABOUT NEW INCOME TAX SLAB RATES AND MORE EXAMPLES.

#IncomeTax #Examples #FY2023-24 #IncomeTaxCalculation #FinCalCTV

============================

LIKE | SHARE | COMMENT | SUBSCRIBE

Mujhe Social Media par FOLLOW kare:

Facebook : / fincalctv

Twitter : / fincalctv

BLOG: fincalc-blog.in

Telegram: t.me/fincalc_tv_channel

Instagram: / fincalc_tv

============================

MORE VIDEOS:

SIP Returns Calculation: • SIP Returns Calculatio...

Income Tax Calculator: • Income Tax Calculation...

Loan EMI Calculator: • Home Loan EMI Calculat...

Loan EMI Prepayment Calculator: • Home Loan EMI Prepayme...

============================

DISCLAIMER:

Examples and demo used are for Illustration purpose only and might not cover every detail of examples shown.

![ZERO Income Tax with Tax Rebate Section 87A | Income Tax Calculation [Hindi]](http://i.ytimg.com/vi/6XZc1ByBLlI/mqdefault.jpg)

![ZERO Income Tax with Tax Rebate Section 87A | Income Tax Calculation [Hindi]](/img/tr.png)

Income Tax Calculation on Salary Video kaisa laga? COMMENT KARO 👇👇

Tax Saving Options:

czcams.com/video/KscdSx9Cvfg/video.html

Income Tax Calculator:

fincalc-blog.in/income-tax-calculator/

JOIN Telegram Group:

t.me/fincalc_tv_channel

@fincalc bro ye excel sheet ka link bhejo bahut helpful he plz

Sir me gross amout 750971-50000=400971 aa raha h new tax regime me kitna tax aa raha h

Sir mai government quarters Mai rahati hu hra nahi milta so income tax kaise kare

Bhau, muze salary me HRA milta he...but muze wo HRA deduction nai Lena so ye case me kya hoga? Explain krna

Hello sir m Sir please btaye ki sip ki saving kon sy option m ani hai??

I just scroll and found this video

Thanks a lot

After my CA Intermediate

It will help me in my practical journey of articleship

Pls continue to make more Video like this

Its make Tax Interesting :)

Also make video in GST too

Very nice. So easily understood. Thank you so much.

Insightful video 👍

Please make a valuable informative video for Divyangjan Employee and vividly analysis with examples. Thanks

Quality content ❤

Sir basic salary ko minimum wage se down nhi kr skte kya?? Minimum wage gross salary ke liye h ya fr basic salary

Is section 80D applicable in new tax regime for example medical certificates Form 10

Sir conveyance allowance 1600*12=19200 Examptions le sakte hai kya after standerd deduction?

Brilliant work

Very thankful sir ❤❤❤

Informative

Very Good Explained sir sir ❤❤❤

Nice Video Bro..

Sir MMLSAY kya deduction mai aya ga kya in income tax computation

Bonus wil be calculated?

If the employer has deducted 30% tax before paying only ?

Sir salary slip me NPS deductions ko gross me consider kare ya na kare

Fd interest add ni hoga kya annual income m?

Impressive and very helpful content.

Grateful to get this quality of content. 🙏🏻

thank you so much for your comment

Keep it up the good work

Very Informative !!!

can you provide this excel sheet ?

Nice video

What about conveyance and medical allowance I think it should also be deducted,please clarify.

Hello sir... maximum amount kitni hoti hain deduction ki...agar sari deduction club ki jayi...koi limit hoti hn ya yeh unlimited hoti hn...

Jordar

If already income tax deducting in my salary monthly, i have to pay tax or not, how to reduce my income tax already deducted amount, can i claim by HRA OR CAN I REDUCE AMOUNT DEDUCTING

How much non tax able income was during 2017_18 for female government

employees.

150000 or 175000

Sir medical insurance yadi 3 sal k h to per year kitna tax exemption milega

New tax regime me koi revlbate nhi hota h tax rate hote? Ye point ka means

Sir ji m disabled employee hu kya muje 80u ki chhut new slab m milega 10:07

My dad pension is 55,000 thousnd per month,will he need to pay income tax?pls response

SIR TDS PE BHE VIDEO BNA DO PLEASE SIR 🙏🙏🙏

Are sir 6.35lac se uper old/new tax regime pe video bnao kaise karein aur invest kaha karein jisse ki 0 tax bne?

Superb video

thanks

I don't know hindi but i really understand the video

thank you

New tax regime me 9 lakh wale income me 50k ka standard deduction claim karne ke baad 8.60L kaise hua 8.50 lakh hoga na..?

Thank a lot.....sir

welcome

Nice video sir

thanks

Well explained

Thanks 👍

Tax calculate march February or April to March??

Bhai TDS v to katega na .. wo to pay kr gi rhe na already

nice and informative video. I am a govt employee and want to calculate my tax as per new tax regime, but I am confused about the 25K calculation of marginal relief. Do you have any video regarding that.

Thanks.

Here's the video on marginal relief

czcams.com/video/Xzht6WDDLb0/video.htmlsi=S7Q72FaiiyZeGyzw

Great man🫡🫡

Thanks 👍

Employer PF amount 1800 also gets deducted from my salary. Should I include that amount amount as well in 80C? 1800+1800?

No wala Standard deduction may jaega..

No

Really awesome

Thanks a lot 😊

Do I have to file ITR or pay tax if my salary gross income is 5.50 lpa, please clarify this doubt.

for salary of up to 5.5 lakh in year, income tax will be zero, but you need to file ITR just to inform govt. about your income and investments. It's better to do so

check this video on how income tax will be zero with examples:

czcams.com/video/6XZc1ByBLlI/video.html

Dear sir pls make a vedio for 58ctc salary according to new tax slab

please use the income tax calculator here:

fincalc-blog.in/income-tax-calculator/

PT Deduction Rs. 300 in Feb month, so total professional tax deduction Rs. 2500/-

Hello Sir Ji, Namaskar

I am a 81% Divyangjan Employee (80 U) I want my benifit Rs. 125000/-

Which Tax Regime is better for me. Please inform me. Thanks 😊

Hi conveyane allowance not taken by you in new tax regime

Ye excel sheet add kr do description me..

Disable person ke liye income tax calculation bata dijiye up to 1000000

Agar 23-24 me new tax regime lete hai to har sal new tax regime hi lena padega ya fir har sal choice milegi?

Har saal choice milti hai

Why does the employer deduct income tax only in specific months? Can someone please help me understand this?

700000 me 87a me kitna rebate hai ???

Mera ek doubt hein plz clear kare yeah jo 80k income tax hey agar koi claim nhi krte hein to yeah amount march ka salary se cut hoga kya agar cut hoga to usko kaise return kar sakte hein plz help me regarding this problem..,... Thank you

every month cut hota hai small amount (80k / 12), total 80K income tax hoga..

Tax deduction options use kar sakte ho Tax save karne ke liye.

ye video dekho: czcams.com/video/KscdSx9Cvfg/video.html

aur ye vala bhi: czcams.com/video/80SC1pE-NvA/video.html

I joined job in 25 Jan 2024. CTC is 9 lakhs per annum how to file for this year please suggest

ITR filing process will start from april 2024 up to july 2024 for FY 2023-24..

80D ka kya hoga aur agar senior citizen hai toh kya alag hoga

I am a CA aspirants mere ko pta h

Jab gross mai se phehle-kar dia, fir dubara krr rehe ho

Complicated