SP500s Intriguing Set Up (Many Are Ignoring THIS) | Stock Market Technical Analysis

Vložit

- čas přidán 2. 08. 2024

- 💎 Get commodities Strategy Session: www.motiontrader.com.au/strat...

🌟 Trade the Trend is a weekly video about where the stock market is heading. It's for investors and traders looking for technical analysis of the SP500, ASX 200, as well as stock markets and commodities markets in general.

00:00 Intro

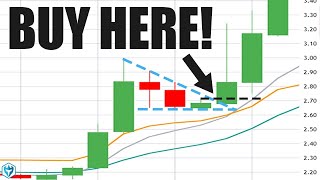

00:30 One of the most interesting SP500 set-ups in years

01:15 Why all-time-highs shouldn't worry you

02:44 Be aware of this key risk factor (it will help manage risk)

04:35 This development isn't normal in a bull market

06:05 Check this out: a range within a range

07:00 Here's the play now (many are doing the opposite)

🔗 Link to ASX 200 video: • Why A Big Move Is Comi...

💎 Get a Free 2 Week Trial of Motion Trader

www.motiontrader.com.au/youtu...

🚀 Motion Trader Investing and Trading insights

www.motiontrader.com.au/

💡 Learn a Systematic Trading Strategy for Free: www.motiontrader.com.au/youtube

⭐ Don't Forget to Subscribe to the Channel

bit.ly/MotionTraderYTS

Jason uses price action analysis and trend following techniques to help you piece together the world's biggest puzzle. Whether you're a beginner or a seasoned pro, you'll get insights that many commentators miss.

💰 You'll feel like you're part of a hedge fund strategy meeting!

If you want a time tested approach to trading shares, investing in the stock market, and managing your share portfolio, then learn from Jason McIntosh at Motion Trader.

Tune in, and put Jason's 3 decades of experience on your side.

#motiontrader #stockmarketanalysis #technicalanalysis #stockmarketmarketcommentary #technicalanalysisofstocks #whereisthestockmarketgoing #whereisthestockmarketheading

GENERAL ADVICE WARNING

The material on this CZcams channel is general in nature. It does not constitute personal investment advice or personal trading advice. Any advice provided is general advice only and does not take into account an individual’s risk profile or financial situation. Trading involves the risk of loss as well as the potential of profit. You should seek independent financial advice in deciding if trading is appropriate for you. Please also consider the appropriateness of the views in this video in terms of your own objectives, financial situation or needs, and where appropriate seek personal advice. As always, past performance is not indicative of future performance. Jason McIntosh is an Authorised Representative (AR No. 1274211) and Motion Trader Pty Ltd is a Corporate Authorised Representative (CAR No. 1274210) of Shartru Wealth Management Pty Ltd ABN 46 158 536 871, AFSL 422409. For more information about Motion Trader and our Financial Services Guide go to: www.motiontrader.com.au

For daily shortlist of high potential ASX stocks, visit

🚀 www.motiontrader.com.au/youtube-free-trial

I really like your calm, considered commentary. Well done.

Thanks for your non-sensationalised presentation Jason.

Always look forward to your videos. Thanks!

Thanks Jason. I always look forward to you commentary.

Thanks Jason, excellent as always 👌👍

Thanks Jason!

Awesome video Jason

Thank you!

Thanks Jason appreciate your podcast informative as always

Thanks for the video.

Thanks Jason, for my weekly update of the matket

Thanks, Jason! Missed you last week

Thanks Jason

Fair dos. I always wanted to say that.

Thanks for the video

I have half my portfolio in the SP500.

Its my long term game

Great insights, thank you 😊

Thanks, Jason.

Awesome Jason. Best on the web!!

great work

Yes, I recall the 1995 rally. With limitations in communication technology, I foolishly backed a technology startup that has now become 'wallpaper'. So thanks for bringing the 'pulse' of the market to my table.

We still struggle to beat the Wall Street insiders and hedge funds, but as you have said previously (and a paraphrase) 'at least we don't have millions of shares to sell when the downtrend start'.

For example, Elon Musk selling major TLS shares without the appropriate reporting (or so I heard & believe it is true).

Great analysis thanks Jason.

I enjoy the weekly updates on the S&P500, keep them coming!

Thanks

Always useful thanks Jason.

Thank you Jason

Thank you

Thanks Jason🙂

Thanks for sharing🙌

good stuff

good observations .. who would a thunk it?

Cheers buddy

Jason i would love to see you on Sky Business with Ross Greenwood on his 5.30 pm show talking Markets it would be brilliant.

Thank you. Also point out that in a wave structure, at least in a 5-wave impulse sequence, two of the three trend waves (impulse or motive waves) will be of similar length.

If the longest wave comes after a shorter wave, which is that case thus far, that means the longest wave is likely a Wave 3. Then after the next similar-sized pullback as Wave 2 had, we can then expect a final 5th Wave rally at least to complete the 5 wave sequence of that degree (or that level). Since two of the waves are usually somewhat similar in length plus or minus roughly 30%, The 5th Wave and final move of that degree will be either roughly the same length as the first wave up, wave 1, or be of similar length as the largest wave, Wave 3. In stocks, and the 5th Wave is usually not the same size as Wave 3 unless it's a blow off top, which could then be the case. Very much most often the third wave is the longest, acceptance some commodities where fear is the greatest motivator and in crypto where fear of missing out of the final wave of massive gains causes the 5th Wave to be the largest many times.

In the current case are the s&p500 capital waited, and the Dow30 and NASDAQ100 weekly charts, this is likely still just a giant third wave in an even larger 5th Wave, and an even larger third wave going back to 1932 low.

Timing?

The 93.4 year cycle and the 23.7 year cycles top sometime between November of this year and February 2025. That doesn't mean that the cycles couldn't lean to the right (alright translation) to provide a longer rally into, say, early 2027 or 2029 to make a hundred year cycle top. But this far, 2026 is looking to be the next down year, and one that could begin a 3 to 5 year bear market.

Note that the 5th-year in a decade tends to be the strongest year of each decade for US equities. That may seems impossible right now do it all the political instability and things that could go wrong geopolitically, but that's just what history shows me now.

By the way, worst 10 not to impact whatever trend of markets on more than an initial shock, which may turn into a correction of the upper down trend it was in prior to the beginning of a war! However with the power of nuclear weapons to destroy grids, the internet and manufacturing bases or dams for an entire country, modern day warfare may cause different outcomes all together.

Hi good comment

Interesting

Thanks for your content

Good stuff Jason, and I think it's a very strong market, for "specific stocks" that

are related to artificial intelligence,(AI) like NVDA, AMZN, AVGO, SMCI, META. Also

a stock I'm watching for only $ 3.00 is called POET, and it was up about 20% today.

I believe big time Investors are really buying into the AI market, and will continue

to do so. Why not put your money where the action is ?? I'm doing that. Ihave a feeling

the overall market for most stocks will stay flat, like it is now. I watch the RSP like you.

Cheers

Brilliant Jason you should be on Sky News wth

Ross Greenwood every night at 5.30 pm.

Both EQAL and RSP since 2024 began have had their daily 50 SMA over the 200 SMA all year so far.

It’s easier to propagandise a few stocks and cryptos.

The narrative control by influencers is impressive to say the least.

Thanks for your continuous update!!! I am super excited about how my stock investment is going so far , making over 28k weekly is an amazing gain.

Thanks Jason!

Thanks Jason

Thanks Jason

Thanks Jason