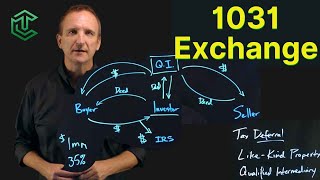

White House Proposal Massively Increases Taxes on Real Estate Capital Gains and 1031 Exchanges

Vložit

- čas přidán 29. 05. 2024

- Join this channel to get access to members only videos and other perks:

/ @investfourmore

The White House has said it wants to completely change the tax code including changing 1031 exchanges and capital gains which would impact real estate investors and business owners. I go over what these changes would mean!

To get the free book showing how I got started in real estate click here: investfourmore.com/yt

----

InvestFourMore Instagram page: / investfourmore

----

InvestFourMore Insider club: investfourmore.com/insider/

----

Direct Coaching with me: investfourmore.com/blueprint/

------

My books: amzn.to/2VGI6a9

Here is more information on another 1031 exchange I did czcams.com/video/nQuBg2fWfzM/video.htmlsi=itWnYwzEzd909P-U

1031 exchange is a good thing. Politicians are corrupt.

I understand the need for taxes, but the government is so dang wasteful. Any person or business that behaved the way they do would be on the street in no time. They get way more than enough money already. It sickening and BOTH parties are guilty!

Agreed. The worst is when they intentionally break the law, gut sued, lose, and they pay tax money dollars to settle.

taxation is THEFT. PERIOD>. not a debate.

The govt.needs to cover the $21 Trillion that spontaneously grew legs and disappeared. The keyword is income. Bill gates makes $80k per year😂😂😂

My country just passed a vacancy tax.

So now I _certainly_ won't build the 4 additional units I planned, disqualify my house for the exemption, and risk paying 12k in taxes.

Wow. Where?

@@investfourmore In western Austria.

It's 3k tax per vacant unit per year.

Also renovations aren't a reason for an exemption.

@@moden321 That is insane.

It's big corporate money seeking to use it's outsized capital to push out the smaller guy. Plain and simple.

Unrealized gains are not income.

Period

Back door wealth tax.

20:43 If you tear down buildings, do they loose their water shares making it more expensive and harder to build something new?

The problem two words: Elizabeth Warren. Bless her heart.

Wow just wow 🤦🏾♂️

yup

Government spends? Nah, it *squanders* at our expense!

I bet if you were to ask Sleepy Joe Biden what his opinion of a 1031 Exchange, he would just look at you blankly.

People enjoy the fact that you have the GVT YOU ELECTED AND YOU DESERVE! YEAH. FREE STUFF FOR EVERYBODY AND $20 MINIMUM WAGE! What could possibly go wrong? It will get worse and the dollar declines further...enjoy your new remodeled country.

Capital gains should always be capital gains. This is doubly true if the supposed swap is a price run up deal. Let me explain:

if you bought a property for say 100k. You then trade it 2 years later for a property at 150k, then your initial property has increased in value by 50k - even if no money trades hands, this is a capital gain and should be realized and taxed accordingly. Further, 1031 exchanges should only be allowed for the principal property of your business (ie, head office or principal place of business).

See the problem is that two people can "value up" their property in a swap. In the above example, each buys their property for 100k. Two years later, they "swap" with a listed price of 150k for each property. They don't have to do much to justify that price. They they each put their "new" properties on the market and selling them for 175k - and only pay taxes on the 25k gain at the end, even through they have actually gained 75k. Some people also use the inflated trade price to justify an 80% mortgage which is higher than what they had on their other property, and they can pay off the original note and "take cash" out of the deal without paying tax on it.

I know it isn't quite that simple or clear, but that is the basics of it. Real estate investors on this level are one of the reasons the economy is going to sh-t.

This is 100% wrong. if those two people were to swap properties that would be a sale and they would owe cpaital gains taxes at that time. So they would pay on the $50k gain and the $25k gain.

Real estate investors actually help the economy and housing. Don't drink the kool aid

I think we should do like Ted Cruz said, and charge EVERYONE ten percent on their income, for tax. Period. And, that's the ONLY thing I agree with Ted Cruz on.

I personally would much prefer to see a VAT tax. Too many now don't file taxes or find a way around paying their fair share.

elections have consequences

Colorado seems to love democrats. Keep voting blue and the Government will continue this madness. This admisnistration is trying to tax you on gains that havent even been recognized yet. So if your investment properties appreciate 100k last year, you have to pay taxes on those gains even though you havent even sold the house yet to capture those gains. Thanks a lot Colorado.

This isn't Colorado buy national

Colorado went blue becaue of weed. Great! Got it.. Why keep voting blue?

Keep voting for Biden. Y'all better vote for Donald Trump if not we are ALL screwed.

Every vote republican is a vote against the ginormous government overhead...hence the insane pushback.