Video není dostupné.

Omlouváme se.

Session 9: More on cash flows

Vložit

- čas přidán 21. 02. 2023

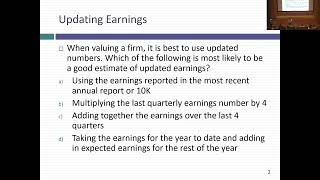

- In this session, we began by looking at broad definitions of cash flows, before embarking on updating, normalizing and cleaning up accounting earnings. In particular, we talked about why we capitalize lease commitments and R&D expenses, and how they affect valuation inputs. We continued our discussion of cash flows, by first putting to rest some final issues on earnings, including the tax rate to use in computing after-tax cash flows and dealing with money losing companies. In the process, we did look at what to do about accounting fraud, and while the answer is not much, there may be a role for forensic accounting. To be honest, most forensic accounting books are designed for valuation morticians, but here are a couple that you may find useful:

1. www.amazon.com/Financial-Shena...

2. www.amazon.com/Creative-Cash-F...

Start of the class test: pages.stern.nyu.edu/~adamodar...

Slides: pages.stern.nyu.edu/~adamodar...

Post class test: pages.stern.nyu.edu/~adamodar...

Post class test: pages.stern.nyu.edu/~adamodar...

The best finance teacher in the world

Indeed!!

The evolution of a finance professional:

* 3 year finance/accounting undergraduate course

* 2 year MBA

* 10 years in investment banking

* Spend 20 hours listening to Prof Damodaran explain what it all REALLY means.

True that!!

I can’t believe we get access to this education… thank you so much Aswath.

Thank you prof for doing all this open source, love you!!!

After listening to such a wonderful prof, I regret for having done engineering and wish I had done Economics and Finance. Thank you Prof. Be blessed always with good health, long life and divine grace🙏🙏🙏

You are the best professor

Thanks for sharing ❤

Thanks for spreading so valuable knowledge for free, professor. I have a question if anyone could help me: when he says that treating R&D as an OPEX increases ROA because it decreases the denominator, doesn't it decrease the numerator as well, nullyfing the effect?

Well, it won't be an equal effect on both numerator and denominator. Let's go through it this way:

Assume an x amt. of R&D for all the yrs. and amortizable life of 5 yrs.

So your unamortized R&D would come out to be 3x and amortization this year would be x.

[You can see it as:

unamortized R&D = x + 0.8x + 0.6x + 0.4x + 0.2x + 0.0x

and amortization = 5*(0.2x)]

Taking the difference, that would be an effective decrease in Equity of 2x while in numerator decrease would be only x [Ignoring the tax benefit in the calcs to simplify]

Thus, we can see how conventional accounting is inflating the Return on Capital.

Hope it's understandable...

My Guru,parnam sir ji

@Aswath Damodaran thank you for the lesson professor. Purchased 2 of your books already. I have a tricky question about the Sales to Capital ratio: when you're estimating the current sales to capital ratio, would you include negative retained earnings in the denominator of the Sales/Capital equation?

My thoughts are that including the negative retained earnings can highly overestimate the metric for a company that's received a lot of funding but has accumulated significant losses over time (and therefore shouldn't be included)

Thank you in advance!

Gui

Retained earnings is not a measure of invested capital. Retained earnings is a theoretical profit accumulation balance - if its negative it means the company has not made any profit over its history, given the summation of all net income over periods.

Keep it simple: there are only TWO SOURCES of capital to fund a business: money thats invested by holders of equity, and/or, money that is borrowed. Anything that doesnt folllow that definition is muted.

Great!

Thank you prof Aswath for this valuable lecture can we get name of forensic accounting reference you mention at 41:00Sec

1) financial shenanigans 2) creative cashflow reporting

I have a question. If we ignore short term loan in current liabilities for noncash working capital since we can add it to the cost of capital then what about when calculating FCFE. We only have cost of equity to work with and we can't add debt to that equation right?

25:42-> Don't you think once we start capitalising R&D (even those with lower probability to be commercialised), it will go against the fundamental element of an asset recognition ('bring in future benefit')?

Hello Sir,

The reason why RnD is expensed is because if the research isn’t fruitful then the entire RnD cost needs to be expensed at once. For ex, if SAP stalled the RnD in the current year then they would have to expense the entire 2.9m capitalised cost to PnL in CY. This would result in abnormal loss. Therefore in accounting only Development cost is capitalised on achieving technical feasibility when the future cashflows can be reasonably estimated.

It's the same logic that you gave for increase in head count.

🔥

Which book are you talking about for forensic accounting

Sir, no sound? Not sure if it's still loading

use earphones

Pls somebody tell my from where i have to be start the valuation lectures , there are multiple lecture have been in playlist and i get confused

Pls guide me

Valuation Undergraduate Spring 2023.

@@Gandharpn brother there are also a valuation playlist in just starting of the channel means 5-6 year ago s, should i have to start from there , ya i have to start from there you mentioned??.

No. Just use recent year. Prof is uploading lectures weekly.

@@Gandharpn thanks brother

@@Gandharpn brother can you tell me is thet lecture sufficient , and Anything i have read after this lectures , any material thet Prof. Have provided , but i missing thet one?.

Is it just me or is there no sound on this video?

use earphones

Starts at 4:02

My lip reading isn't good enough.... We need the sound please.

you have to more your classes more dynamic, otherwise they are boring,

your views reflect that