Pricing and Valuation of Futures Contracts (2024 Level I CFA® Exam -Derivatives - Module 6)

Vložit

- čas přidán 8. 07. 2024

- Prep Packages for the CFA® Program offered by AnalystPrep (study notes, video lessons, question bank, mock exams, and much more):

Level I: analystprep.com/shop/cfa-leve...

Level II: analystprep.com/shop/learn-pr...

Levels I, II & III (Lifetime access): analystprep.com/shop/cfa-unli...

Prep Packages for the FRM® Program:

FRM Part I & Part II (Lifetime access): analystprep.com/shop/unlimite...

Topic 7 - Derivatives

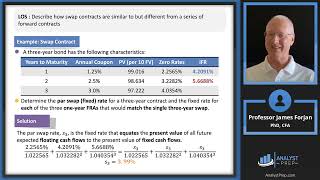

Module 6 - Pricing and Valuation of Futures Contracts

LOS : Compare the value and price of forward and futures contracts.

LOS : Explain why forward and futures price differ.

In example of futures contract with initial and maintenance margin- after mtm loss of USD 768, will 768 USD need to be deposited or just 8500-8106=394 USD

It will be 768

Hi, could anyone please explain why in example 2 (7:20), the formula uses to the power of NEGATIVE 91/365 ? why is it not positive ? thank you!!

Because it is trying to compute the present value of the contract. It is the equivalent notation as putting the discount rate in the denominator. The CFA changed the notation apparently, but, the main point, is that if it is to the power of negative, it is computing the Present Value.

Why don't you use pen or mouse pointer to explain... Your explanation will be much better if you do it..

zhina