Pricing and Valuation of Forward Contracts and for an Underlying with Varying Maturities (Module 5)

Vložit

- čas přidán 8. 04. 2024

- Prep Packages for the CFA® Program offered by AnalystPrep (study notes, video lessons, question bank, mock exams, and much more):

Level I: analystprep.com/shop/cfa-leve...

Level II: analystprep.com/shop/learn-pr...

Levels I, II & III (Lifetime access): analystprep.com/shop/cfa-unli...

Prep Packages for the FRM® Program:

FRM Part I & Part II (Lifetime access): analystprep.com/shop/unlimite...

Topic 7 - Derivatives

Module 5 - Pricing and Valuation of Forward Contracts and for an Underlying with Varying Maturities

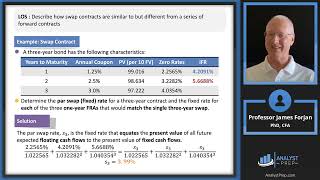

LOS : Explain how the value and price of a forward contract are determined at initiation, during the life of the contract, and at expiration.

LOS : Explain how forward rates are determined for an underlying with a term structure and describe their uses.