Why par yields are the best interest rate measure

Vložit

- čas přidán 24. 05. 2022

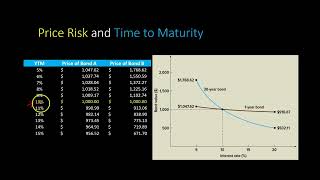

- Par yields are the best interest rate because they summarize the spot rate term structure into a single yield measure. I also show the so-called "coupon effect" which is also an argument in favor of par yields. But I think the better reason is their information content. Yield to maturity (TYM) is also a single (constant) rate but YTM is a function of an observed bond price: the coupon effect exposes this weakness of yield; e.g., when I vary the coupon, get different 5-year yield. However, the par yield does NOT depend on bond price; the par yield is a function entirely of the spot rate curve; aka, discount function.

Here is my previous (detailed) illustration of the par yield: • Par yields are swap ra...

Here is the reddit question ("Can someone explain par rates to me please?") that I answered:

/ can_someone_explain_pa...

Subscribe here czcams.com/users/bionicturtl...

to be notified of future tutorials on expert finance and data science, including the Financial Risk Manager (FRM), the Chartered Financial Analyst (CFA), and R Programming!

If you have questions or want to discuss this video further, please visit our support forum (which has over 50,000 members) located at bionicturtle.com/forum

You can also register as a member of our site (for free!) at www.bionicturtle.com/register/

Our email contact is support@bionicturtle.com (I can also be personally reached at davidh@bionicturtle.com)

For other videos in our Financial Risk Manager (FRM) series, visit these playlists:

Texas Instruments BA II+ Calculator

• Texas Instruments BA I...

Risk Foundations (FRM Topic 1)

• Risk Foundations (FRM ...

Quantitative Analysis (FRM Topic 2)

• Quantitative Analysis ...

Financial Markets and Products: Intro to Derivatives (FRM Topic 3, Hull Ch 1-7)

• Financial Markets and ...

Financial Markets and Products: Option Trading Strategies (FRM Topic 3, Hull Ch 10-12)

• Financial Markets and ...

FM&P: Intro to Derivatives: Exotic options (FRM Topic 3)

• FM&P: Intro to Derivat...

Valuation and RIsk Models (FRM Topic 4)

• Valuation and RIsk Mod...

Coming Soon ....

Market Risk (FRM Topic 5)

Credit Risk (FRM Topic 6)

Operational Risk (FRM Topic 7)

Investment Risk (FRM Topic 8)

Current Issues (FRM Topic 9)

For videos in our Chartered Financial Analyst (CFA) series, visit these playlists:

Chartered Financial Analyst (CFA) Level 1 Volume 1

• Level 1 Chartered Fina...

[Delete all except one set/line of hashtags]

#bionicturtle #risk #financialriskmanager #FRM #finance #expertfinance

#bionicturtle #finance #charteredfinancialanalyst #CFA #finance #expertfinance

#rstats #rprogramming #statistics

Our videos carefully comply with U.S. copyright law which we take seriously. Any third-party images used in this video honor their specific license agreements. We occasionally purchase images with our account under a royalty-free licence at 123rf.com (see www.123rf.com/license.php); and we also use free and purchased images from our account at canva.com (see about.canva.com/license-agree.... In particular, the new thumbnails are generated in canva.com. Please contact support@bionicturtle.com or davidh@bionicturtle.com if you have any questions, issues or concerns.

From the practical point of view - zero curve term structure is based on market prices od risk free rates, with longer term utilizing FRAs and IRSs.

So talking about difference between YTM and Par Rates, market prices are included in par rates but via ZC term structure and not directly like for YTM.

Which means that, theoretically, for riskless bonds par rate and ytm should be extremely close and difference may be a result on how often ZC is updated and what is current ASW spread of particular bond

Thank you, that's helpful insight!

Nice! Hope you keep posting more videos again 👍

Thank you for the support!

Great lecture, thanks!

Super video! It was very well explained :)

Great Explanation!

8:57 -> why par rates are the best in Bionic Turtle's View

Someone please help me out here. So par value is a.k.a. face value, principle value, or future value or what?

And then is the par yield same as a rate (coupon rate?) that makes the sum of cash flows equal to face value?

Or is the par yield analogous to IRR- the rate that makes NPV equal to zero?

1. Par value and principle value is the same. 2. Par yield is a hypothetical coupon rate that makes the sum of the PRESENT cash flows equal to face value. 3. I don't think par yield is analogous to IRR. We are using different spot rates for different coupons here.

I still don't get it....from what I can tell by the words alone, you are saying that the par rate is better, but how is getting less money better? You are paying $100 for a coupon to get some of that money back per year and in-so-doing you get less interest on the rate of the reserved note and then you get the "original" back but you multiplied it by the anum, which is a reduction of the actual put forward....all-in-all, it's less than you would have gotten just having a CD go full to end because of exponentiation.

I know I'm dumb when it comes to bonds, they are a wildly retarded setup to be honest for markets and could easily have a much more intuitive design...but they went with this weird par and yield garbage that just confuses everyone. Plus, I make 40% per year average over the last 20+ years on the stock market, so I've never seen a reason to enter the realm of bonds that are going for less than 3% majority of the time. Yes, I do beat the market, consistently, because I employ several mathematically sound strategies...and yes, it isn't sustainable longterm, eventually I'll reach a point where I can't possibly take on more risk to unload it fast enough, so it'll eventually teeter to market rates, but that's when/if I ever reach about $3m+ in capital (I tend to spend my money when I get it).

🍀 քʀօʍօֆʍ