Why Deferred Tax Liabilities Get Created in an M&A Deal

Vložit

- čas přidán 17. 03. 2014

- Why Do Deferred Tax Liabilities Matter? They're part of any M&A deal.

By breakingintowallstreet.com/biws/

You'll find you always see them in the purchase price allocation schedule, and they impact the combined company's taxes after the deal takes place.

You see them all the time, especially for highly acquisitive companies like Oracle.

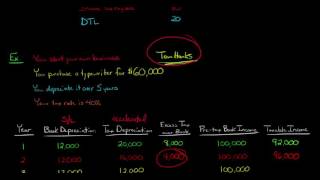

They reflect the fact that there are TIMING differences between when a company records taxes on its publicly filed Income Statement and when it actually pays those taxes.

Specifically, when a buyer writes up the seller's PP&E or Other Intangible Assets in a deal, the buyer depreciates or amortizes them over time... but only on the BOOK version of its statements!

It can't do that on the TAX version of its statements it files when paying taxes to the government, which means that the actual amount of cash taxes it pays will be different from what's on its Income Statement.

Here's the Easiest Way to Think About DTLs:

Instead of thinking about the company's historical situation or its taxable income, think about its FUTURE TAXES.

If future cash taxes exceed future book taxes, a DTL will be created.

We need to pay ADDITIONAL taxes for items that are not truly tax-deductible.

If future cash taxes are less than future book taxes, a DTA will be created.

We will pay LESS in taxes than the company's book Income Statement implies.

As the book and cash tax payments equalize over time, the DTL or DTA goes away.

Two Most Common Questions on DTLs:

"Wait a minute - why does a DTL get created immediately? Isn't it caused by the book and cash taxes being different many times historically?"

Nope, not necessarily - that CAN be a cause, but DTLs/DTAs can also be created by events that change the company's FUTURE tax situation.

So you need to think about how taxes will change in the future, not how they've changed in the past, to determine this.

"Wait a minute, the taxable income for book purposes is LOWER than it is for tax purposes - doesn't that create a Deferred Tax ASSET (DTA) instead?"

Nope. The relevant question is not how the taxable income differs, but how the FUTURE TAXES will differ.

If the company will pay more in cash taxes than book taxes in the FUTURE, as a result of these write-ups, or any other changes, then a DTL gets created.

![How to Calculate Goodwill in M&A Deals and Merger Models [Tutorial]](http://i.ytimg.com/vi/m5p0D3kV72g/mqdefault.jpg)

+John Oh Yes, the time required for the DTL to go to zero over time is a function of the projected operating income to some extent. But for the DTLs created in a deal like this, the projected operating income doesn't really make a difference because the DTL changes based on the difference between tax and book depreciation, which is tiny relative to most companies' operating incomes.

Thanks so much for the video. This helped answer the question I was struggling with for hours!

Thanks for watching!

Thanks for this and all of the videos/tutorials that you put up which are extremely helpful. Just a quick clarifying and confirmatory question here, but the time it takes for the DTL to essentially be "realized" will be a function of what you are modeling out for the combined operating taxable income going forward. In order words, if taxable operating is much higher than initially forecasted when the deal is consummated more cash taxes will ultimately be paid, bringing down the balance of the DTL created at original deal?

thank you so much on this! was so confusing before and this solved my question

Thanks for watching!

Great explanation. I am new to interpreting financial statements, and was pretty difficult to understand and look for information explaining why some companies have so inflated deferred tax liability.

Thanks for watching!

Great videos, Brian. Well technically, in cell E27 ( which is cash tax of 40) - its a DTA right because DTA Means you are paying more taxes today ( and hence will pay less in future). However, in this case since DTL gets created immediately in an M&A, we are able to use the DTA to offset this immediately created DTL overtime ( of 44). Does this make sense ?

Thanks for the video, very clarifying. I have a question on the other side of the double-entry. When I acquire a company, I understand I can allocate a portion of the purchase price to the fair value of intangibles. These are amortized on book basis but not on tax basis, and this is fine to me. Thus, we create a DTL. On the other side of the DTL I have read that we are "grossing-up" intangibles to double-keep this operation. Then, over the next years, the DTL will shrink as a result of the amortization of the intangible. My point is: what about the value of the intangibles "grossed-up"? Shouldn't the value of the DTL be lowered by the difference between cash and income taxes? How does the grossed-up amount go down over time? I hope my question is clear enough.

Each year in a merger model, you reduce the Intangibles balance by the annual amortization and you reduce the DTL by the difference between book and cash taxes. So both of them actually decrease each year.

I wouldn't say that you "gross up intangibles to double-keep the operation." Instead, the fact that you *write up* Intangibles, PP&E, and possibly other assets *results* in a DTL being created on the L&E side of the Balance Sheet.

The Intangibles balance will decrease over time because they have a definite useful life, and some portion of that will be reflected in the decreasing DTL as well.

Thanks for much helpful video! Let me confirm one point. Regarding the taxable income, In case goodwill is made in the transaction as a result of PPA, should we also add amortization of goodwill to taxable income?

Goodwill is no longer amortized under U.S. GAAP or IFRS. It is still amortized under Japanese GAAP, which is what you are asking about from your name (I assume).

Amortization of Goodwill appears on the book financial statements under J-GAAP, but it is still not a cash-tax-deductible expense, so it contributes to the DTL as well.

Hello, Brian

Just to clarify: the only reason a DTL is created is because, in this example, the Acquirer company writes-up the value of the Target company's assets, and in the combined IS the D&A will be higher (reducing the taxable income), which, in turn, cannot be used to reduce the actual taxes paid by the company - is this correct?

BTW, why cannot the company use D&A from write-ups to reduce its taxable income?

Thank you for your help, and keep up the great work.

Yes, that is correct. Companies can sometimes use D&A from asset write-ups to reduce their taxable income if the deal is structured as an asset purchase rather than a stock purchase. But for most standard public company acquisitions (structured as stock purchases), it's not allowed, as it would let companies "game the system" and write up the values to too high a level just to reduce their taxes.

Hi BiWS, thanks for sharing the video. A follow up on this topic, what goes on the asset side to offset this DTL or is the equity reduced by the amount of DTL created to balance the balance sheet. Reducing the equity seems like the only choice ....

Ankushh Partap Goodwill offsets the DTL... if the DTL created is a higher number, Goodwill will also need to be higher. If the DTL is lower, Goodwill can also be lower. Equity is not impacted at all by the creation of DTLs or the lack of DTLs.

Mergers & Inquisitions / Breaking Into Wall Street

Thanks a ton BiWS. Makes sense that the Goodwill offsets the new DTL.

Interesting concept! Can I check how how do we deal with deferred tax assets? Is it derived the same as Asset Write-down* Tax Rate? (so asset - write down) * tax rate?

I'm not sure I understand your question. Deferred Tax Assets are generally created when an expense is not cash-tax deductible in the current period but becomes so later on. Examples are stock-based compensation and asset write-downs and impairments (assuming the company eventually sells the written-down assets). The DTA initially increases when the expense is incurred and then decreases when it becomes deductible.

I think the confusing point here is not to thing about DTL/DTA from future perspective, but from the current perspective. Here is the simple rule:

DTL - If you paying less cash taxes today ( means high book taxes but lower cash taxes), you will have to shell out more in future

DTA - if you paying more cash taxes today ( means low book taxes compared to cash taxes), you will have to shell out less in future

Yes you could think about it like that as well

HI ! Thank you for your video. When you're calculating the future DTL at 9.24 min, should it not be the opposite ? As book taxes are lower than cash taxes, we pay less than we should be paying therefore a liabilities is created ? Thank you for your answer !Keep the good work that is so usefull !

No, because a Deferred Tax Liability refers to future taxes. If future cash taxes exceed future book taxes, a DTL will be created. We need to pay ADDITIONAL taxes for items that are not truly tax-deductible.

The liability reflects that need to pay more in the future. As we do pay more in the future, the liability is reduced over time and eventually goes away once cash taxes equal book taxes.

Mergers & Inquisitions / Breaking Into Wall Street Perfectly clear. Thank you very much for that. Keep up the AMAZING work !

Mergers & Inquisitions / Breaking Into Wall Street

how does this differ from a traditional DTL not in an M&A deal?

Question on DTLs - What happens if the asset is sold before its estimated useful life? Ex. PPE cost = 200mn, Estimated useful life 4 years, Taxes at 30%, Company uses straight-line depreciation for financial reporting (depreciation expense for each of 4 years = 50mn), but accelerated method for tax reporting (dep. expense = 100mn for 1st two years and 0 for the remaining two years)? Company records a DTL of 15mn each year for the first two years as it accounts for higher income tax on income statement vs. that on tax return/filings. What happens to DTL and shareholder's equity if company sells asset at carrying value (100mn) beginning of 3rd year ? Thanks

The DTL would have to be adjusted down to reflect that that difference between book and cash taxes will no longer exist after the sale. So, Cash, Retained Earnings, the DTL, and the Asset value would all change in the Balance Sheet adjustments, and there might be a Gain or Loss on the Income Statement as well.

Thanks a lot for the video. Quick question - If the acquirer would have a permision to deduct the D&A from this write-ups, what new item will be generated in his Balance Sheet?

No DTL would be created in that case.

Thanks for the video, it helps a lot. However, I'm rather confused because based on a Co I'm studying now, it has both DTA & DTL on the B/S These were created as a result of acquisitions done recently. This co has +ve pre-tax income.

You stated that if only when future cash taxes > book taxes, DTL is created, but if cash taxes < book taxes, DTA is created. If future cash taxes > book taxes for the next 5 years, what do we do with the DTA? How do I sort of go about projecting the DTAs?

I've also gone through the other videos you did on NOLs & deferred tax liability, accelerated depreciation, and SBC. But i find it hard to tied back to what should i do with the DTA.

I can't really say without seeing the company and the documents. But it is possible for DTAs to be created in deals as well; it's just that after a deal closes, there should always be a *Net* DTA or *Net* DTL in place, i.e., one of these new items should be bigger than the other. If Cash Taxes > Book Taxes, there will still be a Net DTL... easiest way to deal with it is take the DTL and subtract the DTA to get the net number and then just include a single Deferred Tax line on the CFS.

@@financialmodeling Got it. Thanks buddy, appreciate the response.

I have one question, I believe everything here is correct, however there is one key point missing (i would say). deferred taxes are only created on temporary differences, so in the end cumulatively the tax expenses as per your tax filings should allign with your financial statements over the years right. In this example I see indeed that book tax expense is lower compared to cash taxes, however this is the unwinding of the DTL overtime. Isn't the creation of the DTL also caused by a difference in taxable vs book income?

I guess my question is how would you show that tax expense as per your books equals the actual taxes paid as per your tax statements? Because in this example I cannot see that.

You don't see it here because we're not showing the full cycle, only what happens after the deal and before anything gets sold again. If the acquirer actually re-sold the target at a loss reflecting the cumulative D&A on these write-ups over time, its Cash Taxes would be lower, and cumulative Book and Cash Taxes would be equal. But no one ever builds this into M&A models because the timing is uncertain.

Hi Brian

Does the existing DTA/ DTL of the target become redundant in an acquisition ,Or does the DTA still reduce future cash taxes ?

The target's existing DTAs/DTLs are typically written down to 0 in an acquisition as all book/cash tax differences are reconciled in the deal, but it also depends on the deal type... if part of the DTA corresponds to NOLs, that may persist afterward depending on whether it is a stock, asset, or 338(h)(10) deal.

@@financialmodeling Looks more of accounting stuff ! but thankss !

Great videos as usual! Maybe a stupid question, but what if I do the following:

1. Acquire a company with a PP&E of 100 (seller DTL goes to 0)...

2. ...with a writeup of 20%, so PP&E of 120 (therefore I get an increase in D&A and a new DTL to counterbalance it)

3. My company is acquired by someone else (seller DTL goes to 0)...

4. ...without any write-ups, keeping the PP&E of 120 (therefore no changes in D&A and DTL)

5. And there we have a company with 120 of PP&E (therefore larger D&A tax-shield) and 0 DTL :^)

Of course, there is something wrong with my logic, but I cannot find what. Could you help me with this?

Thanks!

I think you're greatly over-thinking this point. Yes, something like this could happen, but it would make such a small difference that it's not even worth thinking about. Also, even if there is some previous write-up, if the DTL goes to 0 after an acquisition takes place, the parent company will most likely keep recording the original D&A associated with the PP&E and not record anything associated with the write-up.

In a share deal example where the company is fully consolidating a subsidiary it has purchased and the parent does not file group tax returns then what is the reasoning of the DTL. The subsidiary will keep the book value of their assets at historical cost and depreciation and it will potentially have DTL in the standalone accounts due to difference between local GAAP depreciation and local tax allowances, but at conso level why is there a DTL since the consolidated entity is not filing for consolidated tax returns. Is it because of potential liability upon exit?

A DTL does not necessarily get created in all cases, but in most standard M&A deals where one public company acquires another one and the group files taxes, it does, and that is what this video is referring to.

If there is a deal where the parent does not file group tax returns and the subsidiary keeps book values at historical cost without write-ups, then there will not be a DTL. The DTL is only created when assets are written up for book, but not tax, purposes. This gets into topics that we do not specialize in (tax law), so we do not have additional information or examples.

Many thanks @@financialmodeling. So one of the conditions is that the parent files for group taxes?

Not sure I would say that. For a DTL to be created, there must be a book write-up of assets but no tax write-up. We are not regulatory or tax law specialists, so I cannot comment on how the tax filing requirements relate to this point. You should consult a corporate tax attorney.

I have a question let’s say a company issues corporate bonds and in the process the company creates DTA , what happens to this portion in a merger? Do the acquiring company acquires this DTA? Or does this stay with the sellers corporate parent in case the DTA is accumulated at parent level ?

I don't know why a company would create a DTA as a result of a corporate bond issuance, but if a company has an existing DTA and then this company gets acquired, the treatment of the DTA varies based on the type of acquisition and what's in the DTA. In asset purchases and 338(h)(10) deals, you write down the seller's entire NOL portion of the DTA because NOLs are completely lost in the deal. In stock purchases, the buyer can still use at least a portion of the seller's NOLs post-transaction, so you only write down the portion that cannot be used by the buyer. For DTAs that result from other items, such as temporary/timing differences, you normally write down these types of deferred tax line items and reconcile all the differences upon transaction close.

Mergers & Inquisitions / Breaking Into Wall Street my understanding is the cost of bond issuance is amortized throughout the life of the bond, plus any premium or discount received. This is a deferred tax asset is what I am thinking.

OK, yes, sure, but this makes such a small difference that you ignore it in most models... only DTAs arising from M&A deals or significant D&A differences, NOLs, etc. are worth thinking through.

Mergers & Inquisitions / Breaking Into Wall Street sure thanks! So is there is a minimum limit you don’t care about , say $10M in DTA from bond issuance ?

There's no strict guideline, but we generally do not care about items that represent less than 5% of a company's Assets and almost always simplify and consolidate smaller line items like that.

May I ask why the deferred tax liability at the start is 44?

It's based on the Asset Write-Up * Tax Rate, so (85 + 24) * 40% = $44. That is the amount of extra Cash Taxes that the company will pay over time as these items are depreciated, with depreciation not being deductible for tax purposes.

@@financialmodeling Thank you for the reply! So for DTA, it'll be Asset - write up * Tax Rate?

@@mashedpotatoes8580 ??? You don't create a DTA if there's an asset write-up.

@@financialmodeling I'm sorry- I meant write down. I'm curious as to how dta is settled and handled.

@@mashedpotatoes8580 A DTA write-down is normally shown as an IS expense that is also non-cash-tax deductible, so it's a non-cash add-back on the CFS that reduces the company's DTA on the BS. Many companies did this in 2018 after tax reform passed because DTAs were worth less at a lower statutory tax rate.

Is this just relevant for US GAAP ?

No. DTLs are created in deals worldwide because D&A on asset write-ups is not deductible in Stock Purchases (i.e., purchases for 100% of the company, including all assets and liabilities). There may be some exceptions in certain countries, but I don't think any large country does this differently.