Marginal Tax Rate vs Effective Tax Rate

Vložit

- čas přidán 14. 08. 2021

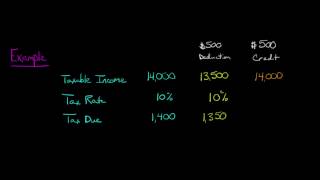

- Your effective tax rate is not the same as your marginal tax rate.

Let’s say you live in a country where your first $10,000 of income is taxed at 10%, your next $30,000 of income is taxed at 15%, and any income beyond that is taxed at 25%.

If you had $60,000 of taxable income you would owe $10,500 in tax.

That’s an effective tax rate of 17.5%.

But your marginal tax rate, which is the tax rate that would apply if you earned an additional dollar of income, would be 25%.

-

Edspira is the creation of Michael McLaughlin, an award-winning professor who went from teenage homelessness to a PhD. Edspira’s mission is to make a high-quality business education accessible to all people.

-

SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS:

• A 23-PAGE GUIDE TO MANAGERIAL ACCOUNTING

• A 44-PAGE GUIDE TO U.S. TAXATION

• A 75-PAGE GUIDE TO FINANCIAL STATEMENT ANALYSIS

• MANY MORE FREE PDF GUIDES

* eepurl.com/dIaa5z

-

GET CERTIFIED IN FINANCIAL STATEMENT ANALYSIS, IFRS 16, AND ASSET-LIABILITY MANAGEMENT

* edspira.thinkific.com

-

LISTEN TO THE SCHEME PODCAST

* Apple Podcasts: podcasts.apple.com/us/podcast...

* Spotify: open.spotify.com/show/4WaNTqV...

* Website: www.edspira.com/podcast-2/

-

GET TAX TIPS ON TIKTOK

* / prof_mclaughlin

-

ACCESS INDEX OF VIDEOS

* www.edspira.com/index

-

CONNECT WITH EDSPIRA

* Facebook: / edspira

* Instagram: / edspiradotcom

* LinkedIn: / edspira

-

CONNECT WITH MICHAEL

* Twitter: / prof_mclaughlin

* LinkedIn: / prof-michael-mclaughlin

-

ABOUT EDSPIRA AND ITS CREATOR

* www.edspira.com/about/

No music, no drawn out intro, no begging for likes and subscribes, no beating around the bush. Immediately got right to the point. Thank you!

Great explanation thanks

Love the shorts 👍 great work

Thanks! 😊

Appreciate the no-frills explanation. Cheers

No problem 👍

Thanks for the vid. It cleared things up! But the last part- "If you have an additional dollar of income ($60,001.00??) your marginal tax would be 25%? I thought it already was 25%? I'm trying to figure out the additional dollar statement meaning.

You're absolutely right, it already was 25%

It's just that marginal ALWAYS means one more 'something', so in this case the marginal tax means the tax on an additional dollar, which in this case is also 25%

So you're absolutely correct!

Thank you.

You're welcome!

This is great thank you 😄

Good knowledge for free🙏

I think a lot of tax payers don’t know the marginal tax rate works