Securitization and Mortgage Backed Securities

Vložit

- čas přidán 1. 09. 2021

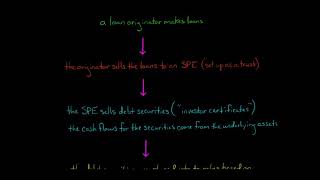

- Historically, banks were almost entirely reliant on deposits to raise funds. But in the past few decades banks have found alternative sources of funding. One of those sources is securitization.

Securitization is the process of bundling illiquid financial assets and then creating securities that are backed by the cash flows from the pool of financial assets. The financial assets can be packaged in such a way that each bundle of assets has a different risk profile.

Many banks securitize mortgages, for example, which creates a mortgage-backed security (MBS). A mortgage-backed security is a financial instrument that derives its cash flows from a pool of mortgages. You can have residential mortgage-backed securities (RMBS) or commercial mortgage-backed securities (CMBS).

Mortgage-backed securities are a special type of asset-backed security (ABS) where the underlying asset is a mortgage. Asset-backed securities can also be backed by credit card receivables, car loans, student loans, equipment loans, etc.

Valuing mortgage-backed securities and asset-backed securities is difficult because the cash flows are uncertain. This is due to:

• interest rate risk

• prepayment risk

• default risk

Some banks use Monte Carlo simulations to estimate the value of MBS or ABS.

Securitization has several advantages:

• It removes risky, illiquid assets from the bank’s balance sheet

• It reduces the bank’s regulatory capital requirements

• It raises cash and increases liquidity so the bank can underwrite more loans

The investors buying the securities benefit from being able to invest in mortgages (or credit card debt, car loans, etc.) without having to originate or service the mortgages.

-

Edspira is the creation of Michael McLaughlin, an award-winning professor who went from teenage homelessness to a PhD. Edspira’s mission is to make a high-quality business education freely available to the world.

-

SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS:

• A 23-PAGE GUIDE TO MANAGERIAL ACCOUNTING

• A 44-PAGE GUIDE TO U.S. TAXATION

• A 75-PAGE GUIDE TO FINANCIAL STATEMENT ANALYSIS

• MANY MORE FREE PDF GUIDES AND SPREADSHEETS

* eepurl.com/dIaa5z

-

SUPPORT EDSPIRA ON PATREON

* / prof_mclaughlin

-

GET CERTIFIED IN FINANCIAL STATEMENT ANALYSIS, IFRS 16, AND ASSET-LIABILITY MANAGEMENT

* edspira.thinkific.com

-

LISTEN TO THE SCHEME PODCAST

* Apple Podcasts: podcasts.apple.com/us/podcast...

* Spotify: open.spotify.com/show/4WaNTqV...

* Website: www.edspira.com/podcast-2/

-

GET TAX TIPS ON TIKTOK

* / prof_mclaughlin

-

ACCESS INDEX OF VIDEOS

* www.edspira.com/index

-

CONNECT WITH EDSPIRA

* Facebook: / edspira

* Instagram: / edspiradotcom

* LinkedIn: / edspira

-

CONNECT WITH MICHAEL

* Twitter: / prof_mclaughlin

* LinkedIn: / prof-michael-mclaughlin

-

ABOUT EDSPIRA AND ITS CREATOR

* www.edspira.com/about/

* michaelmclaughlin.com

HELP😭 so its the signature of the people who sign the contract. With no consent they sell the ABS. An never think i have the people on the primary Market pay the contract and sell it on the secondary Market and keep all the profit an proceeds.

The money should go back to the creators of the contract (the people)

Fraud 🤨🤬🤨😩😭

Can someone answer my question, when a loan is securitized it’s sold and removed from the banks balance sheets. Does this mean the loan is showing paid off?

Yes

Why can’t we do a 1099c then?

@@Ic_truth you can. When a loan/account is sold or charged off, the company reported it as income to the irs. A charge off according to the IRS, is income because the debt was paid off. You have to pay taxes on the amount that was discharged. the company is supposed to send you a 1099C copy b so you can file taxes on it because the debt is charged off. They never do and they never tell you they sold your loan and is making money off it. They instead have a collecting agency trying to collect the account. If a debt collecting agency comes after you, you can use that law against then. Also charges cannot be reported to your credit, because they are technically income.

How do or can ordinary people or small investors buy Securitized products?

Go to the web site and look for investor or a broker or open TDA account or fidelity tell them what stock you want to buy and how many. But if you want to buy and sell securities you have to become a broker. Also if you want to sell your on light bill or car contract you have to take them to your bank and talk to the private banker study hard you have to know what your talking when you talk to them or go to jail🤪🙏😇👌

Cut off a bit early

Hmm. Why would investors take on the risk associated with these mortgages? Surely, they know that the people selling them are incentivized to generate as many mortgages as they can. And, surely, they know that this incentive likely causes them to fudge and otherwise overlook income and credit requirements that would otherwise protect these investors by mitigating against the risk of a default, no?

Basically, you’re selling me something that I KNOW has a very good chance of being a bag of shit. Why would I buy that? Lol. Especially given that these credit rating agencies slipped up in the past? Boggles me.

Usually the bank itself holds either the worst part of the package or a certain % of the whole amount themselves.

So the bank doesn't want to get too risky since it is itself invested