The Time Value of Money in Finance - Part II (2024 CFA® Level I Exam - QM - Module 2)

Vložit

- čas přidán 24. 04. 2024

- Prep Packages for the CFA® Program offered by AnalystPrep (study notes, video lessons, question bank, mock exams, and much more):

Level I: analystprep.com/shop/cfa-leve...

Level II: analystprep.com/shop/learn-pr...

Level III: analystprep.com/shop/cfa-leve...

Levels I, II & III (Lifetime access): analystprep.com/shop/cfa-unli...

Prep Packages for the FRM® Program:

FRM Part I & Part II (Lifetime access): analystprep.com/shop/unlimite...

Topic 1 - Quantitative Methods

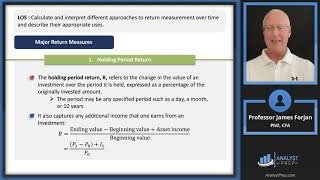

Learning Module 2 - The Time Value of Money in Finance - Part II

- LOS : Calculate and interpret the implied return of fixed-income instruments and required return and implied growth of equity instruments given the present value (PV) and cash flow.

- LOS : Explain the cash flow additivity principle, its importance for the no-arbitrage condition, and its use in calculating implied forward interest rates, forward exchange rates, and option values.

35:19-.math seems incorrect. Instead of EUR1,853,I am getting EUR 1,867.

May I ask what the "Reinvested Coupons" are and how they affect the Present Value of coupon Bond, please? Thank you!

Dt(1+g)= Dt+1, not Dt(1-g).