Capital Budgeting: NPV, IRR, Payback | MUST-KNOW for Finance Roles

Vložit

- čas přidán 30. 06. 2024

- Learn the main capital budgeting techniques: NPV, IRR, and Payback Period using real-life examples on Excel.

🆓 DOWNLOAD Free Excel file for this video: view.flodesk.com/pages/627e30...

📈 The Complete Finance & Valuation Course: www.careerprinciples.com/cour...

In the video you'll learn assess whether you should accept or reject a project based on the Net Present Value, the Internal Rate of Return, and the Payback Period calculation. Throughout, explain some of the limitations of each method. We'll go over the theory for each, and then we'll apply our learnings on Excel using their built-in formulas.

Firstly, we'll introduce capital budgeting, going over what it means and what kind of projects are usually assessed using this method. Then, we'll introduce our scenario, which is working at Nike as a financial analyst and trying to decide whether to accept or reject the opening of two new Nike stores.

For the NPV, we'll consider the time value of money, discount rates, and other important factors. For the IRR, we'll first explain the theory followed by using the IRR formula on Excel.Lastly, for the payback period we'll first calculate it and then introduce the Discounted Payback Period which does account for the time value of money.

LEARN:

📈 The Complete Finance & Valuation Course: www.careerprinciples.com/cour...

👉 Excel for Business & Finance Course: www.careerprinciples.com/cour...

📊 Get 25% OFF Financial Edge Using Code KENJI25: bit.ly/3Ds47vS

SOCIALS:

📸 Instagram - / kenji_explains

🤳 TikTok - www.tiktok.com/@kenjiexplains...

GEAR:

📹 My Favorite Books & Gear: kit.co/kenjiexplains

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

Chapters:

0:00 - Capital Budgeting

0:41 - NPV

4:46 - IRR

7:12 - Payback Period

Disclaimer: I may receive a small commission on some of the links provided at no extra cost to you.

![IRR vs. NPV - Which To Use in Real Estate [& Why]](/img/n.gif)

👉 Learn Finance & Valuation: www.careerprinciples.com/courses/finance-valuation-course

Your lived in which country brother

Can you share with us the discount code for the course?

Big fan

Hi Kenji, can you share a discount code for this course please.

Most of your videos are simplified & which is one of the reason becomes more interesting & help to understand a lot

you explain the topic in the simplest way....easy to understand. I'm always searching finance topics i have a hard time understanding in your channel.

Well explained. I thought this would be too hard to do, but you made it easy. Can't thank you enough ❤

Bro you summed up my entire grad in an simple way❤

Thanks Kenji. Studying for a final this is super helpful

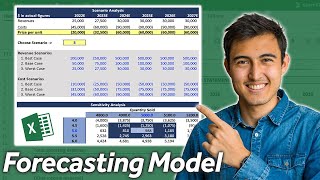

Looking forward to your talking about scenario analysis, base, best and worst case. How this can make the model more realistic

The simplest method ever to calculate payback period. From Madagascar, thank you so much

Great to hear! Thanks for watching

You make complex topics easy to understand. Thank you for sharing your contents. 🙂

That's awesome to hear thank you!

I liked how you took real examples and explained everything through excel😍👏👏. After long time I enjoyed learning finance😌✨✨ super happyy🌟

Keep going man, finance is easy with you !

This is amazing. Thank you for sharing your content.

So well explained!

Great fundamental exercise for financial analysts 👍

Thank you!

Thankss a Lott sir. Whole chapter explained in one video😍👏👏👏👏

Thank you for this video. I was struggling to understand this just by reading the textbook and thus affecting my grades. You are now my go-to to understand financial management topics

You're very welcome! You might also find this video useful: czcams.com/video/1KvrQOQPCDI/video.html

@@KenjiExplains thank you! I will check this out.

Great content as always! Thanks man!😁

Cheers Andy!

Wow I never seen like this......simplicity.....from Ethiopia

thanks for sharing the video man lovely video

Great content as always!

Really appreciate it Daniel!

Hi kenji, How are you? I, am from Bangladesh, enjoy your blog as you make a content which helps finance processional or finance graduate like me. Please would you mind to telling me which excel tools ( i means excel's various technique and tools) are carrying significant - and should be learnt - to the finance discipline.

Great video and well explained,

Quick question please, does the cash outflow related to project cost only or it is also included the operation expense? And how to determine the discount rate? Thanks

Great video, i am wondering if you can make a video covering how to prepare a Budget ?

Amazing Kenji!😁

You are too good, well explanatory

Very helpful explanations

very helpful thank you.

Amazing video! Do you have any tips for someone who is going into summer analyst intern program at a bank?

Thanks al lot for this wonderful video

omg thank you so much, you saved my life

Well explanatory

Thanks so much.

Great,thx.🙏

Best channel

Thanks a lot.

great video thank you very much

Glad you liked it!

I'm here for the learning, not necessarily due to your smile. No not, really. 🥰😊

hahah thank you XD

Amazing video

Awesome 👍🇯🇲🇯🇲🇯🇲

Hii Kenji why don't you start teaching us VBA as well

it's also great tool to learn

Good job. keep it up.

Thank you that's the plan!

Do you have any videos on cost benefit analysis?

Its very nice teaching. Please attach if you have PPT note

Well explained thank you, but the subtitles are covering the diagram in some instances during the explanation

You’re better than my teachers!!

Hahah thanks!

So, all these inflow figures are estimated? How to calculate Inflows from only project 1?

Thank you for your answers.

hello Mr kenji, i got two quik question, what about when we have our own caopital, and bank loan, should we insert it on the cash inflow, and also if possible do you have a video that u explain further on financtial term such as ROI, ROI etc... Ty

Dear Mr. Kenji I would like to known from where the cash inflows and outflows come. In my university life the tropics are taught us like that ways. I will very helpful if you informed me

Genius.

your videos are very useful. is you course on linkedin.

Watching this 20 minutes before my test begins. LFG

Hii can you explain what's role of working capital

While I'm preparing NPV statement

Like what does the working capital means here 😅

how do you determine the discount rate?

Super

Good

thx

Should we consider bank funding the project also as investment or consider Equity only as investment for IRR calculation ?

Please add the video for Cash flow (Direct, Indirect) thanks in advance

Working on a cash flow video for next week!

How do you calculate the Discount Rate? if I only have the "Breakeven period" and the "Payback Period" ?

How do we find out the discount rate though? Can you also go over that aspect?

WACC

How do you get the cash inflow data before even creating the store?

on what basis did we choose discount rate as 8%. Was it just an assumption?

Can you explain the discounted payback in more detail?

You use the same technique as for the payback period but you discount the cash flow. Instead of summing all the cash flows to get the cumulative cash flow you sum the discounted cash flows.

Great answer!

Hi Kenji,

Hope all is well!

Kindly be informed that the discount coupon is no longer working, so need your support to provide me with an active one

When will you get a 0% IRR but still have a very big NPV?

any question, where you have 1.500.000 in project 1?

can you help me to explain....

Flodesk did not send me the download after I submitted my email address. Flodesk not ready for prime time?

Flodesk finally provided the download once I turned off my VPN.

What about terminal value? Don't we need to include that?

For the payback period, shouldn't it be 3+ (45,000/495,000)? seems like the PJ needs only 45K to break even, and 3.9 years is too long!

how calculated Payback in month and day

If a comp has a negative npv, then it doesn't have a payback period.

what if there is cash inflow (from capital injection or debt) to finance the project? can we add that cash inflow in period "0"?

the IRR cell on your excel file has an error

You did't explain and show how to CALCULATE the discounted payback period. I didn't get it from the video.

MIRR

Your lived in which country brother

Studied in the US but I'm from spain :)

I don't understand why we pick the first project if the second one is going to give us more return with less investment. Besides the payback period is lower in the second one.

Watch the video again, it seems that it was not very clear to you why the first project is a better option.

Hola, blogger, soy Catalina, la gerente de planificación de BitBank, estoy muy interesada en trabajar contigo y espero saber de ti.😊😊😊

I’m from Goldman Sachs

please I need scholarship to be enrolled in your program

For a few months now I have been searching tirelessly for information on how to start investing. I even payed $1000 for a course that I now regret. It appears that there is no structured guidiance for beginners on how to get started in this realm. I've come across several investors making well over $250k/annum and would be grateful if anyone on here could provide insights on how to get started, identify potential stocks, when to make an entry, exit etc.

First

Hahah nice! See you on next week’s video hopefully!

cOUPON FOR THJE COURSE? YO HAVE CONTENT IN SPANISH?

Despite the economic downturn, I'm so happy 😊.I have been earning $ 60,000 returns from my $7,000 investment every 13days.

Hello what's the best way to get started with trade cos l've been making my personal research for a while now please a newbie?

All you need as a beginner to make good profit from Bitcoin is a professional trader who will| trade on your behalf else you may make losses

That is true, you need an expert trader to make good profit from Bitcoin trade,My life has totally changed since I started with $7,000 and now I make $ 39,450 every 11 days..

I will recommend my current trader Mrs Angelia Marie Brown ,she is from USA and her strategies are earning a lot of profit for me

communicate with her directly on 👇👇

What’s your LinkedIn?