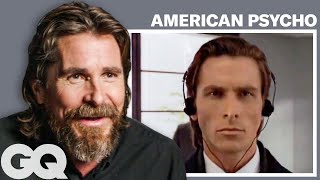

Explaining Celebrity Explanations in The Big Short

Vložit

- čas přidán 29. 05. 2024

- If you'd like to support the channel, you can do so at Patreon.com/ThePlainBagel :)

The Big Short is a great movie on the 2008 financial crisis with some awesome celebrity cameos. These cameos explain complicated financial products with funny analogies, but today I thought I'd explain the topics a bit further.

DISCLAIMER:

This channel is for education purposes only and is not affiliated with any financial institution. Richard Coffin is not registered to provide investment advice and as such does not provide recommendations on The Plain Bagel - those looking for investment advice should seek out a registered professional. Richard is not responsible for investment actions taken by viewers.

You mean they explain it in 'Lehman's' terms.... I'll see myself out

Hahahaha 😭😂😂😂😂

The police have been notified.

Outstanding.

Please check your inbox, we have sent you a cease and desist for libel.

FBI Open up!

Who needs Margot Robbie in a bubble bath when we can have Richard Coffin in front of a Game of Thrones poster?

Good one lol.

I only stared at Margot Robbie so I didn't understand what she was talking about

🤤🤤🤤 she gets me going so bad

@@StuffedBox Boobs--what, uhhh stocks, yeah

I do man.

This happens often in mathematics research as well. A researcher at a university is forced to keep pumping out papers, so they makes mistakes, then other researchers base new concepts on those mistakes, the other researchers and it continues until someone finds the root mistake and allll the research ends up wrong like a domino effect.

That's a really illuminating analogy that makes this whole thing easier to understand. Thanks. :)

Academia is rotten

@@ginosuinoilporcoinvasivo8216 yeah, in some aspects, it's seriously broken.

@@ginosuinoilporcoinvasivo8216 e se lo dice gino suino il porco invasivo non posso che fidarmi

How could anyone expect tenure without pumping out papers non-stop in the current research environment?

3 years later: Explaining explaining the explanations in the big short

A synthetic CDO of explanations 😂

I heard that reaction to the reaction to the explanation's explanation gonna be big next year. To the moon! 🚀🚀🚀

This happens often in mathematics'

It is now 3 years later. Let's have it, lol.

3 years after your post the algorithm serves this video up to me

FYI whenever you have a movie based on real people or events, and the names of the characters are different from those of the real people, it's because A) the real people didn't want to give their permission to be portrayed, B) the studio or production team didn't want to bother with securing those rights, or C) sometimes a movie character is a combination of real people (either for sake of interest or because it's just a bit character), therefore no real name can be used.

In regards to your "C," the female scientist in Chernobyl was based off of like, 15 real life scientists in the USSR at the time that all were quite similar in their thinking about the crisis.

Which is interesting because Steve Carell's character has a fake name, but is a 1:1 of the real Steve Eisman discussed in the book, and his partners at his firm - Vincent Daniel, Porter Collins, and Danny Moses - all have their real names.

The rl Brownfield Fund guys have openly said they wanted to still have a personal life after the book and the resulting movie, so their names were modified

when he said "about" i knew he was canadian, good video btw

> at a thanksgiving dinner

> **RELEASES THE VIDEO AFTER CHRISTMAS LIKE A BOSS**

The scene of the side bet with Selena and Richard is wrongly executed, after she loses all the people is regreting their decissions when actually half of the people should be celebrating

I always took that in terms of what actually happened to the American economy. Because half of the people didn’t win. At least that was my takeaway, yes it was an explanation, but I thought it was an explanation to the specific narrative that the movie was telling, not just an explanation of how those kinds of derivatives work in general. Maybe I’m wrong

You are right..The ones who paid premiums for the synthetic CDOs should be making a fortune..But I think they did not want to show the whole group in a literal sense ..

It's because pretty much everyone lost out because of the crash in the long run. Think about it, you may have made money because you shorted the market, but that means people lose jobs, they lose retirements, and that could easily have been someone you knew.

The film does explain this when a couple of the investors on the short side start celebrating, and Brad Pitt yells at them. Shorting means only very few get to profit from a catastrophic event that will ruin the lives of many innocent people.

I dont know enough about this event but should they?

Wasnt it so bad that no one could pay those "bets" so in the end there was a lot of "you have to pay me" but no one paid?

I don't agree because the people who turned a profit on the big short we're easily less than a percent of the whole group affected, not even including the entire country. So the metaphor/analogy is fitting

I actually liked this type of video and would not be opposed to having some more come out. I watched the movie and uderstood the first two parts but the Selena Gomez one was a bit confusing so you clearing things up really was a big help, so thanks! I really appreciate it!

I think that part was an oversimplification in the movie. Just having a binary win/loose scenario doesn't make sense to have synthetic CDOs building on other synthetic CDOs and not on the first CDO directly

So you like explanations that are incorrect?

This is actually quite helpful since even with the celebrity cameos I was still confused for the most part.

I'm still confused, by design.

My favorite scene in this movie was with the rating agencies one. It wasn't with a celebrity but omg that scene I think it explained the whole movie letting the viewer know and aware how bad and corrupt the system was.

Ur such an underrated CZcamsr this video is great

Great video! Spot on commentary to an already great movie...

The movie didn’t talk about it either, but a couple aspects of Credit Default Swaps that are interesting/important are:

A) they are technically exactly like insurance, but were called “swaps” so that those contracts wouldn’t be regulated like insurance (which requires the issuer to have some percentage of the potential payout held in reserve, just in case)

B) when the banks that issue mortgages buy CDS’s (basically insuring their mortgages against failure), that effectively took the risk of the mortgage off of their books, and allowed them to issue even MORE new mortgages... continuing the MBS->CDO->CDS cycle.

C) BUT, since the issuers of the CDS’s (e.g. insurance) didn’t actually have the money to pay out if/when the mortgages defaulted, the mortgage lenders were actually just continuously ratcheting up their risk level until even the smallest blip in mortgage payments brought the whole thing crumbling down.

Holy crap this is a good insight. Thank you so much

You've got the right idea basically, but not really. It was the mortgages themselves that caused the problem; if a mortgage went bad the bank repossessed the house keeping the down payment and the payment made up to that point. More often than not, they made money!.

What you're talking about are mortgaged backed securities (I see you do write MBS so I think your on the right track). There are many things I can talk about right now but I'll talk about the biggest part of the problem. It isn't just the issuers didn't have the money per say, it's because in 2000 a law was passed keeping CDS's (actually derivatives in general) unregulated. Therefore it was "anything goes" and what really happened was investment firms learned they could make money by trading CDS's as if they were stocks. Worst, since there were no regulations, they could make money issuing more than ONE CDS per MBS. I know for a fact (because my last task at Lehman was to electronically transmit derivatives so I had to study them) that in 2007, for every MBS there were between 7-10 CDS's.

So bottom line, a $100,000 mortgage going bad caused a MBS to lose $250,000 (you had to add the interest it would have made to the loss) causing the issuers of the CDS's to pay out but because there were as many as 10 CDS's, the total payout was $2.5 MILLION.

And that was the real problem.

BTW - what was the last job I held? I was in charge of all electronic trade communications in the Mortgaged Backed Securities department of Lehman Brothers (Chicago) for over 12 years.

@@bjbell52 thanks for the info from inside the walls! I don’t disagree with anything you said. I was just pointing out an interesting piece that was covered in the book, but glossed over or skipped in the movie. I don’t disagree that the whole thing was complex with enough blame to spread in many places. The lack of adequate reserves on CDS’s is one high impact piece of a larger puzzle. And the issuing of many CDS’s against one MBS definitely played a huge role in increasing the systemic risk (although if every CDS was covered with reserves on the seller’s side, that risk would have been much lower)

@@bjbell52 Pure gold buried in the comments

Thank you for this explanation. It's helpful.

3:35 by the way... When you hear sub prime.. think SHIT! THAT'S MY FAVOURITE LINE 😂

Michael Lewis also wrote 'Moneyball', which was also made into a film with Brad Pitt. I haven't seen the film, but the book is also worth a read if you're into that sort of thing (which if you watched the film and this video, you probably are).

As a person who got out of the housing market entirely in 2006 because of a divorce, the collapse of the housing market was a silver lining during a difficult time in my life. Sorry to those who got caught in the aftermath.

Pardon the anecdote but here's how the movie timeline parallels my life. We sold our home in Utah after the divorce where the market was still hot. I moved to Ohio and the market was completely different. There were so many for sale signs that I couldn't make any sense of the value of the homes. I opted to live in an apartment for a while.

Whew!!!

People were in a frenzy leading up to the housing collapse. You could do no wrong in real estate. People would leverage debt to get rich or simply refi to buy a new truck. I get that same feeling from people who are investing in stocks right now. I hear, "why pay down debt when I can make way more in the stock market?"

@@Grosbolt because that's basically the same as taking out a loan and then investing it. Sure the long term gain is bigger than the loan interest. However if the stock market makes a dip once putting you in the red on paper the one giving you the loan will force you to sell your investments to prevent further losses which realizes your losses and you'll end up having nothing. Depending on your leverage the dip doesn't even need to go far down. That's what happened in the 1930s.

If you don't pay your mortgage and instead invest the money and you end up in a real estate crash again you might get foreclosure and then your investments will be seized to cover the loss.

Loan basically gives you leverage both ways. Small gains make big gains, small losses can make you bankrupt.

@@tomlxyz If you gain, you gain big possibly 2x or more. If you lose, you only lose 100% of it. If you are a good financer, you'd take the risk, particularly the poors

Those who don't recall their past are condemned to repeat it, this vid is great, man, thank you!

Loved this one. Lots of value add, Richard. Thank you!

You should give Margin Call a re-review. It had a lot of the same elements, but in a much tighter story and script.

For the Selana Gomez and Richard Thaler explanation, I think there is an interesting nuance that they missed. By setting it up as a bet, the idea is that if all these people "lost" money then it implies there is another side of that bet that "won" money.

However, as I understand it, what really happened is that billions of dollars simply "disappeared" from the economy. The vast majority of money in (mostly digital) circulation is not produced by the Fed or US Mint, but by the regular everyday business of loans. And the money derived from the MBS products and CDO's also was circulating as those were traded and sold. So when the loans defaulted massively, all that money based on the credit market essentially evaporated from the economy which is what the "credit crunch" - the most simplistic term for it - referred to. Is that correct?

"I am going to try and find moral redemption at the roulette table"

Great video ... really nice job on this one 🤘🤘

Thank you for your explanation! The Big Short is literally my fav movie!

This video was value added!

Also goes to show we need stronger regulation to keep this stuff from happening. Dodd-Frank didn't go far enough and even it's been rolled back in part.

Kinda glad you made this. I haven't seen TBS but from the clips you showed it looks like their metaphors are so abstract they wind up not explaining much.

Really awesome video - I've watched the movie several times and I still learnt something (especially from the Blackjack analogy)

thank you so much for explaining the last scene! it never clicked for me that the synthetic cdo were comprised of cds; I had just accepted I'd never understand that scene

This was very informative (especially for the one about Synthetic CDOs). This movie does do a great job at taking a complicated subject and not only explaining stuff to the general audience, but also making it still entertaining as well. But even they couldn't explain everything perfectly so I'm glad you were able to elaborate some stuff even further.

Honestly, I had to watch this movie 3 - 5 times to understand what was really going on and everytime I watched it the value of the movie gets deeper and deeper.

This is very informative thank you explaining. Thank you @ThePlainBagel!

Thanks! And Merry Christmas! Watched the whole thing 🙂

Thanks for this explanation. I was waiting something like this from the moment I saw that episode.

Yes, you added great value!!! Sure the movie explains what´s going on in essence but I needed to understand it in actual finance terms and you did that, thank you!!

Thanks! Please continue putting out this type of content!

I worked as a collector in a mortgage company back in 2008. One of the products the company sold was Adjustable Rate Mortgages or ARMs. In theory the bank would forego much of the vetting that determined a potential client's creditworthiness; instead the loan's interest rate went up or down periodically, depending on borrower behavior. Pay regularly before the due date, interest rate goes down. Be a shit borrower, the rate goes up. Pretty straightforward until the marketing department decided to lure people in with a "2% rate for 5 years" or "interest-only for 5 years" kind of deals. At the end of the promo period everyone's interest rates obviously went up because, let's face it, in spite of the bank's goodwill in reaching out to folks who couldn't get loans because of their credit reports, most of them were still essentially bad credit risks. Monthly payments went up, more and more people defaulted, this put a strain on the banking system, etc.

You definitely added value. Thanks for the explanation.

Absolutely loved it, thank you.

Thank you for explaining clear how the short actually works!

Saw the movie several times but you did add to the explanations, thanks. Subbed!

Thanks for explaining, another one would be awesome! 🙂

Amazing video, a really good idea to explain these cameos

Thanks for this video. Such a great movie, and you make it better

Amazing explanation, I'm keeping your video in my finance lessons! By the way, there are many videos which deserves an explanation like Barbarians at the Gate, Wall Street, Wall Street 2, The Banker. If you have sometime I would love to see your comments on those ones! Cheers!

Great analogies this is the best explanation of CDO's & mortgage back securities I've heard. ❤

You did add value.... Especially with the last one...thanks

I really like this video 👍 thanks for the full explanation. It helps understand it!!!!

Great video! Def keep doing these.

Great video man! When I watched the movie it did leave me with some blank spots but you did a nice job covering it 👍

Man, Mr. Bagel. Well done and thank you.

4:40 There was also an issue with the agents working for the lenders telling people "don't worry, in 3 years you just re-mortgage, use the money to pay off this mortgage and get the same low rate for another 3 years"

It wasn't that people didn't know how the balloon interest rates worked, it was that they assumed the value of the house would increase and they would either sell the house or refi before the higher interest rates were due.

Which I believe he covered under the “hot hand fallacy”

Thank you, I understand just a little bit more now.

Thanks for explaining the explanations. This really helped

Thank you man for the great content!

love your explanation man. thank you so much.

@9:30 I think it means it refers to combining two BB to make AAA AA, A, BBB, BB and again combining the BBs to make AAA again. Great video ♥️

Great material ! Keep it up!

Anthony Bourdain’s laugh at the beginning of his cameo makes me smile and breaks my heart at the same time. ❤️🩹

Watching this I feel the same feeling I had when the market crashed. Very good explanation

Yes, you added value! Great vid.

Fabulous explanation! Love it

Great idea doing this. It certainly helped me after I have seen the movie. Liked.

Please do more, great job

I enjoyed it, and you should do more, the value you added wasn't that i hadn't understood before, and now i do... it was just that re-stating something i've already heard in your voice, ads value to me... its fun to watch.

Awesome video, thank you!!

Love your creative film editing

That was awesome , great video !

I like the creative video idea, great explanations.

for the “synthetic CDO” section the things I wanted to know when I watched the movie were:

1. why would anyone make or sell a synthetic CDO instead of doing business with mortgage-backed securities?

2. how did the existence of synthetic CDOs affect the eventual crash?

i think the answers are:

1. more investors wanted to get in on the “safe money” of mortgages than the real housing market could support; likewise, institutions could sell these attractive financial products without having to go through the messiness of actually buying or holding anything

2. the existence of synthetic CDOs magnified the amount of value at risk in any potential housing crash; the collective effect was the entire economy being over leveraged on housing which increased the pain of the crash

i am curious how close i am with those answers!

denk wel aardig juist , zeker bij vraag 2. vrij herkenbaar als je in crypto doet de laatste jaren

0:23 _yeah. this is_ *_big brain_* _time!_

In Chile, insurances (MTL, PP) companies are swapping with our money for retirement (AFP), investing in C tranche (50/50% risk "initially") like is usual on the CDO-squared by investing on High-yield emerging market, making bubbles foreward. Awesome content on your videos, blessings from the world's butt

Great video dude, cleared all my doubts

Great explanation. I understood a few words. Bought more GME. thanks!

You did a great job I love your explanation

Thank you so much this helped a lot!

@15:21 I'm still convinced to this day that due in that shot is the Epic Meal Time guy.

Always thought this would be an interesting topic 👏🏻👏🏻

Continuity error with the glass of champagne @ 3:42

Well done Mr. Bagel. I am amused and amazed at the cross pollination of terms between Vegas and Wall Street. Many times I have heard someone describe gambling at a table as an investment and vice versa. Any wonder some crap out?!

Great explanation of synthetic cdo

Great video. Thanks.

Finally after like 10 videos I understand it good enough tp explain it to others.

Hi, financial rookie here. There's one aspect of the mortgage bond / mortgage backed security I don't understand:

1) the bank, which could simply make money off the interest on its mortgages, instead makes money from the sale of these individual mortgages to the investment bank. Straightforward enough.

2) However, I always thought that when issuing a bond, whatever entity was issuing it (in this case, the investment bank) was actually borrowing money from investors, who in turn should ideally profit from the interest. So what I don't understand from the video is how the interest rate on the individual mortgages translates to the investment bank making money off the mortgage-backed securities.

3) If my understanding of how bonds work is completely wrong, I still don't understand how does grouping mortgages together increases the in absolute value of the interest paid on those mortgages. After all, 2% interest on two $1 million loans is the same as 2% interest on one $2 million loans.

Please help me out here! (Richard is great at explaining this stuff, by the way. I'm just a financial nitwit.)

Thanks for making that - i have seen the movie 1/2 dz times….. and i really enjoyed you breaking it down….. you should do a breakdown of Margin call- good discussion- thanks !!

I suggest you all to read "Fools Gold". It's kind of more complicated than these cameos show. CDS, SIVs, CDOs and a bunch of financial engineering structures. The meltdown itself was triggered by frozen money markets, I remember back then in 07 everyone knew the housing market was collapsing, it wasn't just two guys with special intuition like this movie portraits. god damm

Great help… thanks

"Now f*** off"

- Yes mam

😂😂😂

very helpful, thank you

this was great. more like this!

You added value on the third one

Great explanations!!!

Thanks. It is good explanation!

You are the best bro (y) please continue with your work

Wow I loved it! Thank you for taking your time to do this. I was shocked at synthetic C.D.Os but then came the synthetic C.D.O squared... how can regulators in U.S let this happen? I guess at that time nobody really understood... thanks for the video, love your channel!

The derivatives market is unregulated. That’s how.

You should definitely do more like these... 🤓👍

Gillian Tett explained well that CDS was invented as an insurance policy against risks of volitilities. I think you could've expanded on that a bit more in your video. It's a good tool that got misused in the mortgage market.

Also most characters in the film actually won their money through CDS contracts, just like other speculators around the table did.

Thanks and i still need to watch the movie

Thanks for this I actually understood it a lot better

One aspect that I'm not sure was told in the book (or the movie) was that CDOs were structured so that the tranches inside them were by themselves separate investment objects. You could invest in the riskier tranche inside of that CDO in the hopes of a bigger payout or settle for its less risky tranche. Afaik, as the mortgages inside the CDO defaulted the individual tranches defaulted starting from the riskiest so if you had invested in the less risky tranche you could still be okay even if the riskier unrated tranche would have defaulted. The issue here was that the ratings of the tranches were based on... well shit. They were rated falsely.

I can't believe that the practice of ballooning payments in later years and using that on large scale wasn't seen as problematic by the one who actually know what they were doing. I feel like they just played along because they knew that for now they'd profit and long term they'd get out of it before it crumples.

It’s just a musical chairs, and banking on the fact that you will know before the music stops and make a killing. All the incentives were wrong

My issue with this movie is that they never mentioned that is was the HUD who required Fanny and Freddy to back subprime mortgages under the orders of Bill Clinton, that's where the problem started 🤷🏼♂️

Because the director and screenwriters are leftists and want to pretend that it was idealogically right-wing capitalists and the Bush Administration that were the problem by taking advantage of poor immigrants and minorities.

Nice idea!!

Loved this