The Capital Market Line

Vložit

- čas přidán 7. 09. 2024

- This video discusses the Capital Market Line.

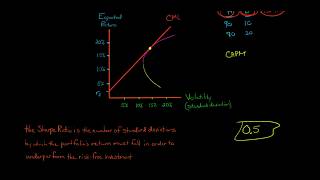

When the volatility and expected return of different portfolios weights is graphed, the line drawn from the risk-free rate such that it is tangent to the efficient frontier is called the Capital Market Line.

Along the Capital Market Line lies a series of efficient portfolios that are combinations of the risky securities with the risk-free investment.

If the assumptions of the Capital Asset Pricing Model hold, then all investors would choose the portfolio on the Capital Market Line that is tangent to the efficient frontier; this is called the tangent portfolio. The tangent portfolio is the market portfolio and it is the portfolio with the highest Sharpe Ratio. This means it provides the highest reward (expected return) per unit of risk (volatility).-

Edspira is the creation of Michael McLaughlin, an award-winning professor who went from teenage homelessness to a PhD. Edspira’s mission is to make a high-quality business education freely available to the world.

-

SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS:

• A 23-PAGE GUIDE TO MANAGERIAL ACCOUNTING

• A 44-PAGE GUIDE TO U.S. TAXATION

• A 75-PAGE GUIDE TO FINANCIAL STATEMENT ANALYSIS

• MANY MORE FREE PDF GUIDES AND SPREADSHEETS

* eepurl.com/dIaa5z

-

SUPPORT EDSPIRA ON PATREON

* / prof_mclaughlin

-

GET CERTIFIED IN FINANCIAL STATEMENT ANALYSIS, IFRS 16, AND ASSET-LIABILITY MANAGEMENT

* edspira.thinki...

-

LISTEN TO THE SCHEME PODCAST

* Apple Podcasts: podcasts.apple...

* Spotify: open.spotify.c...

* Website: www.edspira.co...

-

GET TAX TIPS ON TIKTOK

* / prof_mclaughlin

-

ACCESS INDEX OF VIDEOS

* www.edspira.co...

-

CONNECT WITH EDSPIRA

* Facebook: / edspira

* Instagram: / edspiradotcom

* LinkedIn: / edspira

-

CONNECT WITH MICHAEL

* Twitter: / prof_mclaughlin

* LinkedIn: / prof-michael-mclaughlin

-

ABOUT EDSPIRA AND ITS CREATOR

* www.edspira.co...

* michaelmclaugh...

Thanks. Key Point for me was that the CML represents portfolios that include the risk free asset.

yes, and also you have to extend the idea of efficient portfolios (Markowitz) to an equilibrium condition where all market is held (supply and demand), otherwise you can not conclude that the tangent portfolio is the market portfolio. It's easy to miss that insight because of the simplicity of the model.

Life saver

In 5mins everything is explained

so nicely and smoothly. Thnx sir!

Thank you very much professor ❤️. Keep posting videos. Knowledge forl all/ you are doing amazing job.

u r a genius! having gifted talent in teaching

Clarification about the white line: its the pink dot with varying amounts of riskless asset, the relative weights of the stocks stay the same!

Thank you..

No problem!

Thanks for your amazing video

very helpful. thank you!

Very helpful!

Thanks McLaughlin!

No problem Rusty! I hope life is treating you well!

thanks from France

Great video!

thank you very much

Glad it helped!

thanks for this video

No problem!

So nice

Please help, are we dividing by the standard deviation of the EXCESS market return or by the standard deviation of the market return?

Hey, just a small request/suggestion. In the description, could you also mention the playlist this video is part of. Would be immensely helpful.

Can you explain me what does mean if portfolio lays on the right from CML? Does it make an investor a borrower?

tnx!

Thank you for that 🙏🙏🙏

Awesome Video!

Do you have a scientific paper, that summarizes all of your information?😅

Wow

how do you calculate the expected returns?

its more "historical return" than expected return

Has anybody ever told you that you sound exactly like foodwishes? Amerite?

Hello, could anyone explain to me, how is it that it's impossible to invest in the CML at other points than in efficient frontier? Is it about CML being just the expectation and Efficient frontier the actual possible portfolios? I can't wrap my head around this.

Capital allocation line (CAL) is added to the efficient frontier. Points on capital allocation line (CAL) indicates borrowing (or lending money) to buy more (or less) of the optimal risky Portfolio. CML and market portfolio is special case of CAL and optimal risky portfolio.

So what is the optimum ratio of risk free assets?

ProfitusMaximus depends on the situation. You gotta do the math

Market LInes

What do I do with minus weights? Anybody I have an exam tomorrow?

Negative means you are shortselling

Sharpe is reward to variability not volatility..volatility is captured by beta..and it is trenor

All good, thanks, but...risk-free 4%. Seriously? This is cheating! ;P

Already 5% :)

What incredibly frustrating delivery, at one point he repeats himself for 20 seconds.

zero analysis