Best Indicator for Recession & Stock Market Downturn

Vložit

- čas přidán 16. 06. 2024

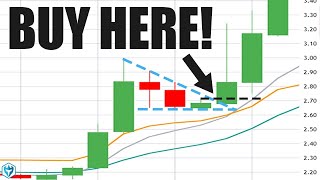

- The steepening in the yield curve from inversion to above 0 is the best indicator of an imminent recession. The decline in the 2-year yield relative to the Fed Funds rate usually precedes the start of rate cuts, which is bearish for the stock market and economy in the context of the recession signal.

Which junior mining stock is one of my biggest investments and has 20-bagger potential? Get your free report here:

thedailygold.com/

RESOURCES FOR YOU......

------------------------------------------------------------------------

★TheDailyGold University Series★

↪thedailygold.com/category/tdg...

★ Learn about my premium service ★

↪thedailygold.com/premium

Follow Me on Twitter:

↪ / thedailygold

#Gold #Silver #How to Invest in Gold

The calm before the storm.

The yield curve has been inverted longer then the 1929 Crash! That should be scaring the Hell out of every investor out there!

Correlation seems dependent on how fast the stock market drops.

Good point. That also factors in.

YIELD CURVE 👍🏿

Looking at that yield curve I feel like I'm on the Titanic! Great Video, Jordan. Love your market analysis. 60/40 and the yield curve!!

Appreciate it!

Well done, sir!

Thank you kindly!

Very helpful have to look at the Gold/Dow ratio but I think it broke out after many years so gold and miners should outperform for rest of decade is my guess.

I prefer Gold to S&P 500 because its more widely followed now but any Gold to stock market ratio is always very instructive.

Great video... As always.. tks

Thank you Jake!

Gold Goats & Guns podcast episode #179, Tom Luongo w/ Vince Lanci, good explanations on interest rates.

Thank you! Any particular time you can give?

2-yr. & 10-yr. un-inversion.

Thank you for the info

You bet

WHAT HAPPENS OW IF THE BANKS ARE IN TROUBLE FED WILL BE FORCED TO CUT RIGHT AWAY?

When do Fund Managers rebalance their portfolios will it be pre or post summer and follow Sam Duncan Miller pivot from Tech into Newmont. ?

End of the month and quarter.

I don't understand, they've been talking about the yield curve inversion for three years now along with the allusive fed rate pivot, impending bank implosion, currency collapse, real estate, treasury, bond and stock market crashes. Do you guys ever get as sick of yourselves as you make us sick of you? Are you paid to make Jerome Powell look sane?

elusive

I don't know what you're talking about Gold's been doing fantastic

The classic "bear steepener"

To be fair, Jordan doesn't really talk about crashes, like stock market crashes, real estate crashes, currency crashes, etc. I agree that all of that is exhausting, and I stopped watching those videos years ago, but Jordan is more level headed and realistic. I'd say dump the other channels and listen to higher-quality, fact-based ones like this and things will feel better. Worked for me.