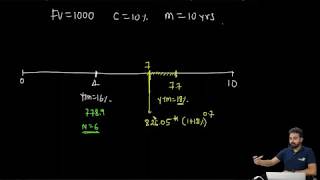

CFA Level II 2020: Fixed Income - Credit Analysis Model

Vložit

- čas přidán 11. 01. 2020

- To know more about CFA/FRM training at FinTree, visit: www.fintreeindia.com

For more videos visit: czcams.com/users/FintreeIndi...

CFA | FRM | CFP | Financial Modeling

Live Classes | Videos Available Globally

Follow us on:

Facebook: / fintree

Instagram: / fintree_education

Twitter: / fin_tree

Linkedin: / fintree-education

We love what we do, and we make awesome video lectures for CFA and FRM exams. Our Video Lectures are comprehensive, easy to understand and most importantly, fun to study with!

This Video lecture was recorded by our Lead Trainer for CFA, Mr. Utkarsh Jain, during one of his live Session in Pune (India).

To know more about CFA/FRM training at FinTree, visit:

www.fintreeindia.com

Even better than your first video explaining this! As always thank you for simplifying.

Awesome video!! Thank you!

Very nice explanation!!

Very nice teacher 👌

is Hazard rate conditional or unconditional? CFA notes seems to say that it is conditional but in 15:39 u mentioned that it is unconditional.

Same doubt....

same

@@MouliBeesetti

What are batch timings for L-2 2020 batch?

Hi Shashank,

Thanks for getting in touch with us!

The current batch for the FinTree CFA Level II Classroom Course is from 1.30 pm - 6.30 pm on Sundays in Pune and Bengaluru and at the same time in Mumbai on Saturdays.

Best regards,

Team FinTree

@@FintreeIndiahi do you have online classroom session ??

when you are calculating the present values for 1,2,3,4 years you are not disounting the coupon payment and divide that with (1+r)n formula.

Can you help us with specific timeline in the video?

Timeline in the video ?

Sir i didn't understand hazard rate

Can anyone explain

@@vivekprasannakumar1826 I would frame it as a rate of loss that is going to be incurred at that particular time on that exposure value, from the example I interpreted as the percentage loss for the year end

Cfa level 2 crash course for August 2021

Plzz