Video není dostupné.

Omlouváme se.

Which investment portfolio is best for you?

Vložit

- čas přidán 9. 02. 2021

- Of the many mutual fund and ETF portfolios on our website, paulmerriman.com, which of the dozen-plus portfolios is most appropriate for you, given your risk tolerance and need for investment return? The goal of this lively discussion - with Paul Merriman, Chris Pedersen and Daryl Bahls - is to help you decide.

Topics covered include:

A short history of the Vanguard, (paulmerriman.c...) Fidelity, (paulmerriman.c...) T Rowe Price (paulmerriman.c...) and Schwab portfolios (paulmerriman.c...) - offered first on the Merriman Wealth Management website and moved to the website for The Merriman Financial Education Foundation (paulmerriman.c...

The Vanguard ETF Portfolio (paulmerriman.c...) as well as the many Best-in-Class ETF portfolios (paulmerriman.c..., including the Ultimate Buy and Hold (paulmerriman.c..., U.S. 4 Fund Combo, Worldwide 4 Fund Combo, All Value, All Small Cap Value, and a series of 2 Funds for Life Portfolios, paulmerriman.c...

Regarding the Ultimate Buy and Hold Strategy, Paul discusses the use of the Fine Tuning Your Asset Allocation Tables (paulmerriman.c...) to determine the best combination of stocks and bonds. Plus, those tables are used later in discussing the 4 Fund Combos.

The many psychological considerations in selecting the right portfolio, explored by Daryl.

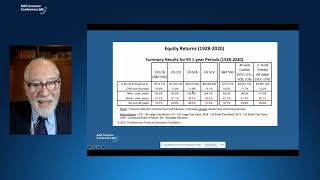

A reminder of how patient a small-cap investor must be, by Chris, who also presents a new Tell Tale chart from 1928 to 2019. (paulmerriman.c...)

Consideration of the pros and cons of each of the ETF portfolios, by Chris. (paulmerriman.c...)

Listen to the podcast here- paulmerriman.c...

This video is part of the educational offerings from The Merriman Financial Education Foundation, a registered 501(c)3. If you found value in this video, here are four ways to support these videos and our foundation:

1) Hit the thumbs up, subscribe and share the link with your social media and friends.

2) Sign up for our biweekly newsletter at PaulMerriman.com

3) Use our M1 Finance affiliate link if you are interested in setting up a brokerage account, using our portfolio suggestions. The Foundation will receive a one-time small fee at no cost to you. m1finance.8bxp...

4) Consider making a tax-deductible donation to the Foundation (paulmerriman.c...) to support our mission to provide financial education to investors. Thank you!

Thank you so much gentlemen for your time and effort to educate us out here who wish not only for our personal understanding but also benefit others going forward.I myself have really got the gold of what you have developed here and plan to implement what I can in my remaining years. I wish to impart this info to my children,immediate friends and future interested people. I believe what Daryl talked about is the crux of all your efforts. We need to understand ourselves and our capabilities of putting this in practice.

As for myself I need to be able to make it a simple process to move forward. I am almost overwhelmed with all the options and some what paralyzed to make my move.Close to retirement I need to make it simple for me but mostly for my spouse to continue on When the dust of my life settles. I love all you do for us and will support you going forward as Your passion shows.

So hard to find nice content like this. I don't know who, but someone actually needs to hear this, you've got to stop saving all your money. Venture into investing some, if you really want financial stability

Invest globally in bitcoin, gold, silver, forex market, commodities. Just don't be left out and save yourself

Beautifully said, I tell my folks these words everyday. It's good to save money but most people don't understand the market moves and tend to be misled in facts like this and always depend on money in the bank.

@Collins Markson Hey, this is a computer age. Peeps who aren't even traders make money from the crypto and forex markets ,how many millionaires do you know who have become wealthy by investing in savings accounts?

Very helpful, this is what I needed to hear today.

@Collins Markson My personal portfolio/investment manager; Mrs Rebecca Leigh Jones , after a whole week of research,she runs an investment platform where you don't have to undergo any stress in the trades, she manages my trading account which i opened with a capital of $3000 and now i have grown my portfolio up to over $6500, a huge success.

So true - you have to know yourself in order to be able to choose the right portfolio for you. Does not matter the portfolio if you can't stomach the ups and the downs.

The 2 Funds for Life is such a unique portfolio. Kudos to Chris for coming up with it. I think it rivals the Bolgehead's 3-fund lazy portfolio in simplicity and return.

I wish someone would clean up the comments section. So many scam artists fishing for victims.

@Super Mutant

I have noticed CZcams’s on investment usually attract scams pushing crypto ‘currencies’.

Thank you for the constant content you all put out! I prefer to emulate the UB&H portfolio so that I can capture broad diversification. The complexity and extra funds do not bother me. I like being technical and more involved.

1) It would be interesting to see a Tell Tale chart also for LCV.

2) All the tables would much easier to read if they were put into a graph.

I am retired with a State Pension and will be drawing and supplementing my pension with Social Security. I am also a small investor and have been putting monthly contributions in a taxable account -Vanguard VTI( Total Stock Index) ETF. How would I balance it with another fund for diversification since I am contributing in a taxable account?

Very valuable educational resources being shared. Thank you.

Paul Merriman and Team, you rock! Knowledge that you provide is powerful. I am 75 years. Never invested in equities. But with the tools that you provide, I feel comfortable in considering equities for my 10 year old grandchild. I am looking at 40 year horizen for him following the dollar cost averaging path for him. Won't miss your podcasts and utube videos for anything.

Thank you all so much for taking the time and effort to put all of this together. God bless you all. What does "rebalancing" mean? I know some of your tables have the caveat of something like 'rebalancing annually', and you also mentioned "rebalancing" in the podcast.

Say you have a 50-50 ratio of stocks and bonds. If the stocks go up by more than the bonds, you might end up with a 60-40 ratio. Rebalancing is selling some stocks and buying more bonds to return to your original allocation percentages.

@@seanohara5754 Ah. So just moving money from one type of asset, like small cap international to something different like large cap international, etc?

@@jonathang5350 That's correct. It's selling/buying to return your portfolio to its original allocation. Like Sean said above: selling stocks and buying bonds, to get back to 50/50.

I personally love the 13-piece portfolio. Makes me feel like I'm smart portfolio manager.

way too many pieces. Stick with VTSAX, VBTLX and probably some VDADX if in or very near retirement.

ty

I think it was JL Collins that referenced the "Know thyself" element of investing

Hi Paul, thank you for sharing your knowledge. I have a question. I am using the Ultimate Buy and Hold strategy. Is it okay to have MGV as my large cap, or should I change it to something like VOOV?

ETF's are commission free at E*Trade.

Most brokers are commission free now. If not they're losing money by charging commission.

Can you recommend a Vanguard Fund, for a taxable account, that's low risk, has a decent return and tax efficient for someone in the 22% tax bracket? Thank you kindly.

Paul, like your videos! Can I make an appointment with you for reviewing my investment? Need your help. thanks!

Respectfully, too many items. Stick with VTSAX, VBTLX and probably VDADX.

Know thyself. If you can stick with those three funds, you'll likely be successful. If two funds for life works best, or the UB&H, that's what you should do. The plan that works best is the plan that you stick to

@@antimagnet , agreed; thanks for the reply. The key is to try to minimize risk and about only way to do it is to diversify among US stocks and bonds and maybe toss in some International. I see stocks tanking today, SP500 was down I believe 1.16% last I looked. Bond yield was up so there is really no place to hide;possibly GLD, but I'm out of my leagues with commodities.