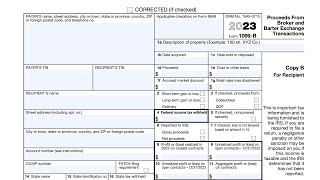

IRS Form 1099-S walkthrough (Proceeds From Real Estate Transactions)

Vložit

- čas přidán 16. 01. 2024

- Subscribe to our CZcams channel: / @teachmepersonalfinanc...

Please feel free to check out our article, where we've written step by step instructions to help you walk through this tax form! www.teachmepersonalfinance.co...

If you’re looking for tutorials for other IRS Forms that you can file directly through the IRS website, check out our free fillable forms page: www.teachmepersonalfinance.co...

Here are links to articles we've written about other tax forms mentioned in this video:

IRS Schedule A, Itemized Deductions

Article: www.teachmepersonalfinance.co...

Video: • IRS Schedule A walkthr...

IRS Schedule D, Capital Gains and Losses

Article: www.teachmepersonalfinance.co...

Video: • IRS Schedule D Walkthr...

IRS Schedule 1, Additional Income and Adjustments to Income

Article: www.teachmepersonalfinance.co...

Video: • IRS Schedule 1 walkthr...

IRS Form 4797, Sales of Business Property

Article: www.teachmepersonalfinance.co...

Video: • IRS Form 4797 walkthro...

IRS Form 6252, Installment Sale Income

Article: www.teachmepersonalfinance.co...

Video: • IRS Form 6252 walkthro...

IRS Form 8824, Like-Kind Exchanges

Article: www.teachmepersonalfinance.co...

Video: • IRS Form 8824 walkthro...

IRS Form W-9, Request for Taxpayer Identification Number and Certification

Article: www.teachmepersonalfinance.co...

Video: • IRS Form W-9 walkthrou...

IRS Form 8822, Change of Address

Article: www.teachmepersonalfinance.co...

Video: • IRS Form 8822 walkthro...

IRS Form 8822-B, Change of Address or Responsible Party, Business

Article: www.teachmepersonalfinance.co...

Video: • IRS Form 8822-B walkth...

IRS Form 8828, Recapture of a Federal Tax Subsidy

Article: www.teachmepersonalfinance.co...

Video: • IRS Form 8828 walkthro... - Jak na to + styl

Thanks for explaining what line 6 actually is - the IRS instructions were as clear as mud!

Thanks from india

Hello, this is really helpful but I have a scenario where my cosin bought a house and issued the titled the house under his name and his fiancée’s name, even though she did not put any money out for the original purchase. They held the property for 2 years and then sold and divided the proceeds 50/50. They both received 1099-S where the gross proceeds reflect 50% of the sale. How would you report this in the tax return? Thank you

My late husband’s estate sold real estate last year. Three properties were completely handled by a title company and all heirs in the estate received appropriate 1099S forms. That being said there were three properties that I purchased from the other heirs and the estate attorney drew up the deeds. Later informing me that they don’t do 1099S. Is it possible for myself to fill out the 1099S for the three properties that the estate attorney handled? I’m also the estate executor and the estate has an EIN.

In the form instructions, there is a hierarchy of who should file this form. I would probably follow this just to make sure that the right party is filing this form.

In general, the party that issued a closing disclosure (or the settlement agent) should handle filing this form. If the Closing Disclosure is not used, or no settlement agent is listed, the person responsible for closing the transaction is the person who prepares a Closing Disclosure that identifies the transferor and transferee, reasonably identifies the real estate transferred, and describes how the proceeds are to be or were disbursed.

If no Closing Disclosure is used, or if two or more Closing Disclosures are used, the person responsible for closing the transaction is, in the following order:

a. The *transferee's attorney* who is present at the delivery of either the transferee's note or a significant part of the cash proceeds to the transferor or who prepares or reviews the preparation of the documents transferring legal or equitable ownership,

b. The transferor's attorney who is present at the delivery of either the transferee's note or a significant part of the cash proceeds to the transferor or who prepares or reviews the preparation of the documents transferring legal or equitable ownership, or

c. The disbursing title or escrow company that is most significant in disbursing gross proceeds.

I’m doing my own taxes using TurboTax. I will receive 1099s form. For box #6 (I paid 1/3 of the estate tax), which form do I have to enter and on which line?

If you're strictly talking about where to report the real estate tax that you paid in Box 6, then you would (if possible), enter that into Schedule A as part of your itemized deductions. If you don't normally itemize deductions, then you may want to see if this tax, combined with any other eligible expenses, would 'push' you into a situation where you're better off itemizing.

Below are some links to resources that I've created about Schedule A. There's also a playlist that breaks down the different parts (including a video that specifically discusses state and local taxes), that may be helpful:

IRS Schedule A, Itemized Deductions

Article: www.teachmepersonalfinance.com/irs-schedule-a-instructions/

Video: czcams.com/video/-7YUwQ6Q1LI/video.html

Playlist: czcams.com/play/PLYHzJrFFCrpy1rgmUyp_4JMBnBvphyqB6.html

Hi: My parents are both deceased and I received their home through their will. I sold their home (I've never lived there) last year and recently happened to recall that there was a 1099-S within the closing documents. Since it was not my primary residence, do I have to pay taxes on the monies I received from the sale?

You should receive a 'step-up' in basis on the cost of the house, effective the date that they passed away. You would pay long term capital gains tax on any gains that are above that cost basis.

For example, let's imagine that your parents bought the house for $100,000, but it was worth $250,000 when they died. You sold the house for $300,000 six months later. You would owe capital gains taxes on $50,000 ($300,000 minus $250,000), not $200,000.

You would report the sale and associated costs on IRS Form 8949, which would then be reported onto Schedule D of your tax return.

IRS Form 8949, Sales and Dispositions of Capital Assets

Article: www.teachmepersonalfinance.com/irs-form-8949-instructions/

Video: czcams.com/video/O5P_L9zdXME/video.html

IRS Schedule D, Capital Gains and Losses

Article: www.teachmepersonalfinance.com/irs-schedule-d-instructions/

Video: czcams.com/video/wpPXe8z40lY/video.html

Playlist: czcams.com/play/PLYHzJrFFCrpx8fntib5MeAQ7xMEfvPVHZ.html

What is the IRS publication you reference? Regarding special cases of expatriation?

Are you talking about IRS Publication 515, Withholding of Tax on Nonresident Aliens and Foreign Entities?

www.irs.gov/publications/p515

@@teachmepersonalfinance2169 yes!!!

Question.

I did 2 wholesale transactions. They were both double closes.

How do I file taxes. I have the 1099 S forms

But it shows 200k on the profits. All I made was 10k on the deal.

This sale only shows proceeds, not profit.

You would use the information on this form to report the sale on one or more of the following:

-Schedule D (for the sale of a primary residence that you cannot exclude under Section 121)

-IRS Form 4797 (for the sale of business property)

-IRS Form 6252 (installment sales)

-IRS Form 8824 (for like-kind exchanges)

When you report the transactions on your tax return, you'll have the opportunity to enter your purchase price (basis), as well as transaction costs, which would help reduce your taxable profit. Below are links to resources for the mentioned forms:

IRS Schedule D, Capital Gains and Losses

Article: www.teachmepersonalfinance.com/irs-schedule-d-instructions/

Video: czcams.com/video/wpPXe8z40lY/video.html

Playlist: czcams.com/play/PLYHzJrFFCrpx8fntib5MeAQ7xMEfvPVHZ.html

IRS Form 4797, Sales of Business Property

Article: www.teachmepersonalfinance.com/irs-form-4797-instructions/

Video: czcams.com/video/2eEaDPh97Zc/video.html

IRS Form 6252, Installment Sale Income

Article: www.teachmepersonalfinance.com/irs-form-6252-instructions/

Video: czcams.com/video/PAeflip0oFk/video.html

IRS Form 8824, Like-Kind Exchanges

Article: www.teachmepersonalfinance.com/irs-form-8824-instructions/

Video: czcams.com/video/YAIJnj64Tqw/video.html

i received this 1099-S form because i sold a Land. where do I report this form in my taxes? do i need to add it on form 8949?

So you probably use IRS Form 8949 to calculate your gain or loss from the sale. You can enter your price paid and other transaction costs to determine this. You may need to report this on Schedule D. From Schedule D, this would flow through to your Form 1040 as either a capital gain or loss.

Below is more information on both Form 8949 and Schedule D:

IRS Form 8949, Sales and Dispositions of Capital Assets

Article: www.teachmepersonalfinance.com/irs-form-8949-instructions/

Video: czcams.com/video/O5P_L9zdXME/video.html

IRS Schedule D, Capital Gains and Losses

Article: www.teachmepersonalfinance.com/irs-schedule-d-instructions/

Video: czcams.com/video/wpPXe8z40lY/video.html

We got a 1099 S because the Department of Transportation took 0.123 acres of our land. Where do I file this? They sent us one for me and my spouse.

If you received some money, you may need to report the sale (or forced sale) on your tax return. If you got more money than the land cost, then you would have a capital gain, while you would have a capital loss if the land cost more than what you received.

I can't tell you what form(s) you need to complete without knowing your tax situation. However, this is from the form instructions (links to articles and videos on the mentioned forms/schedules below):

For sales or exchanges of certain real estate, the person responsible for closing a real estate transaction must report the real estate proceeds to the IRS and must furnish this statement to you.

To determine if you have to report the sale or exchange of your main home on your tax return, see the Instructions for Schedule D (Form 1040).

If the real estate was not your main home, report the transaction on Form 4797, Form 6252, and/or the Schedule D for the appropriate income tax form. If box 4 is checked and you received or will receive like-kind property, you must file Form 8824.

IRS Schedule D, Capital Gains and Losses

Article: www.teachmepersonalfinance.com/irs-schedule-d-instructions/

Video: czcams.com/video/wpPXe8z40lY/video.html

IRS Form 4797, Sales of Business Property

Article: www.teachmepersonalfinance.com/irs-form-4797-instructions/

Video: czcams.com/video/2eEaDPh97Zc/video.html

IRS Form 6252, Installment Sale Income

Article: www.teachmepersonalfinance.com/irs-form-6252-instructions/

Video: czcams.com/video/PAeflip0oFk/video.html

IRS Form 8824, Like-Kind Exchanges

Article: www.teachmepersonalfinance.com/irs-form-8824-instructions/

Video: czcams.com/video/YAIJnj64Tqw/video.html

@@teachmepersonalfinance2169 Thanks! We did receive compensation due to eminent domain. Box 4 is not checked.

I received a 1099-S and after the basis was subtracted from amount owed on property turns out to be less than $250k do I have to still enter 1099-S on my tax return

If you're entitled to exclude up to $250,000 in capital gains due to Section 121, you probably don't need to enter this on your tax return. However, when I read your question, I want to address one point.

Your capital gains exclusion has nothing to do with how much you still owe on the property.

-Your basis is the amount that you paid (whether it was through a mortgage or not) to purchase the property, transaction costs.

-Add your basis to the cost of any capital improvements, like kitchen renovations, new AC, roof, etc.

-Subtract the basis from your sales price ( transaction costs) to arrive at your capital gains figure.

If that amount is less than $250,000, then you don't need to report the sale.

What if I only owned the property for 2.5 years but was my primary residence and sold it? Can this be excluded from reporting? Thanks

@@user-gy7qb2js3v If you owned the property and used it as your primary residence for 2 of the previous 5 years, you may exclude up to $250,000 in capital gains ($500,000 for married couples filing jointly) from income. If this means that you have no gains to report, then you are exempt from having to do so. However, if you still have capital gains after that exclusion, then you would need to report the transaction.