FAMILY TRUST AUSTRALIA: SHOULD YOU SET ONE UP?

Vložit

- čas přidán 1. 07. 2024

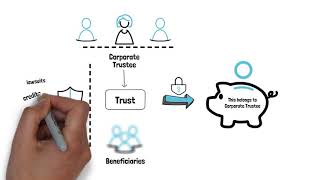

- Out of the different business structures, the trust structure can be the most difficult to understand.

On top of that, there are different types of trust structures, with the family trust structure being the most common.

In this video, we break down what a family trust is as well as its pros and cons.

So if you’re not sure what the trust structure is all about and whether it’s right for you, this is the video for you!

-

Thank you for watching this video. I post weekly videos on this channel to provide the latest and most frequently asked business questions. Please take a second to say hi in the comments below. Also, if you enjoy my comments and find it valuable, subscribe to the channel, like and share it with anyone who you think might find my channel useful!

-

► Subscribe to my channel here:

/ daviemach

-

Davie has over 10 years experience in advising businesses in management accounting and taxation issues. He heads up a passionate team at Box Advisory Group who are dedicated to offering proactive and outstanding service to our clients.

Davie’s extensive experience in providing tax and consulting advice and astute business knowledge has paved the way for success for many businesses.

He is a member of the Chartered Accountants Australian and New Zealand, a member of the Australian Tax Practitioners Board and holds a Bachelor of Commerce degree from the University of New South Wales.

-

Follow Me:

LinkedIn: / davie-mach

Instagram: / boxas_syd

Facebook: / boxadvisory

Website: boxas.com.au/

-

DISCLAIMER: Please note that every effort has been made to ensure that the information provided in this video is accurate. You should note, however, that the information is intended as a guide only, providing an overview of general information available to contractors and small businesses. This guide is not intended to be an exhaustive source of information and should not be seen to constitute legal or tax advice. You should, where necessary, seek your own advice for any legal or tax issues raised in your business affairs.

Video produced by Social Wave

www.socialwave.com.au

Thank you. An Australian channel that talks business. I can relate too. 😊

Absolutely loved this video guys. Thank you so much for sharing this information in a very clean & precise manner. As a director l appreciate this content!!

Please Keep the content coming

Glad it was helpful!

You guys are awesome. Thanks for doing all this.

Thanks for watching!

Nice one guys!🎉

Excellent video thank you! Will share with family members.

Please do, Kerin. Glad you got something out of this!

The other drawback that's not mentioned in this video which I think is pretty significant is that a trust pays a lot more land tax. However if you have more than $3,000,000 in land value then the land tax would be the same, so IMO if you are setting one up to hold properties, only really worth it if you have $3m or more in land value.

Is this land value total that can be spread across multiple properties or a single property only?

@@cassiewestland468 The total in a state/territory. It can be single or multiple properties. Each state/territory have different land tax thresholds for Family Trusts.

Does the split income work for TFN income as well, or does it have to be business or other income?

This video was great. Concises and straight to the point! Plus I think i'm getting a pretty big crush on Davie! He's pretty cute

Thanks Thanh, you always had the crush. Just approach him and be honest!

Brilliant

Thanks for watching, Dee!

Can the Trustee(s) themselves also be their own beneficiary?

Thanks so much for this video!! Very informative. Takes the sting out all of this stuff. My name is JD. Question: Can a Trustee also be a Beneficiary? Couldn't that be a conflict of interest? Question: The Trust protects my personal assets from Creditors, but can Creditors still attempt to sue the Trust? Thanks so much guys!

Explained really clearly, thank you! I read that the 50% CGT is applicable to a family trust, am I correct assuming that if the capital gain is 10000 and the two beneficiaries each received 5000, then when the beneficiary do their tax at the end of the year, they only need to report 2500, am I correct?

Yes

Discretionary Trusts still have PSI rules applicable?

Yes if you earn PSI income

If i am the trustee , can my creditors come after the trust assets?

Best to speak to a lawyer about this

I really need help for this , can I buy property without business??

ofcourse you can, the only thing that will stop you will be coming up with the money via cash/loan

Could I open a trust and buy a property under that trust and rent it out to myself? 🤔🤔🤔

you can, but then you will have to pay income tax on the rental income?

Why tf would you wanna do that

@@TysonTheRand to claim it for tax purposes “claim interest, depreciation, and other associated expenses as a tax deduction “

A lot of big investors do so or rent vest instead

Mate u can do whatever u like the world is your oyster

Can you feature Molly in more of your videos? She is pretty cute.