Equity Method of Accounting for Investments

Vložit

- čas přidán 20. 07. 2015

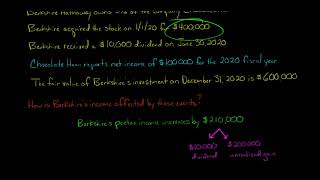

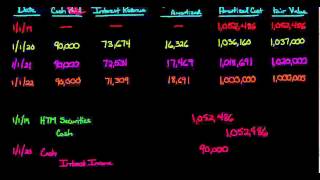

- This video uses a comprehensive example to demonstrate how to account for investments using the Equity Method. When an investor owns between 20% and 50% of a firm's stock, the investor is deemed to have significant influence and must recognize a proportionate share of the firm's earnings.

Edspira is your source for business and financial education. To view the entire video library for free, visit www.Edspira.com

To like us on Facebook, visit / edspira

Edspira is the creation of Michael McLaughlin, who went from teenage homelessness to a PhD. The goal of Michael's life is to increase access to education so all people can achieve their dreams. To learn more about Michael's story, visit www.MichaelMcLaughlin.com

To follow Michael on Facebook, visit

/ prof.michael.mclaughlin

To follow Michael on Twitter, visit

/ prof_mclaughlin-

Edspira is the creation of Michael McLaughlin, an award-winning professor who went from teenage homelessness to a PhD. Edspira’s mission is to make a high-quality business education freely available to the world.

-

SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS:

• A 23-PAGE GUIDE TO MANAGERIAL ACCOUNTING

• A 44-PAGE GUIDE TO U.S. TAXATION

• A 75-PAGE GUIDE TO FINANCIAL STATEMENT ANALYSIS

• MANY MORE FREE PDF GUIDES AND SPREADSHEETS

* eepurl.com/dIaa5z

-

SUPPORT EDSPIRA ON PATREON

* / prof_mclaughlin

-

GET CERTIFIED IN FINANCIAL STATEMENT ANALYSIS, IFRS 16, AND ASSET-LIABILITY MANAGEMENT

* edspira.thinkific.com

-

LISTEN TO THE SCHEME PODCAST

* Apple Podcasts: podcasts.apple.com/us/podcast...

* Spotify: open.spotify.com/show/4WaNTqV...

* Website: www.edspira.com/podcast-2/

-

GET TAX TIPS ON TIKTOK

* / prof_mclaughlin

-

ACCESS INDEX OF VIDEOS

* www.edspira.com/index

-

CONNECT WITH EDSPIRA

* Facebook: / edspira

* Instagram: / edspiradotcom

* LinkedIn: / edspira

-

CONNECT WITH MICHAEL

* Twitter: / prof_mclaughlin

* LinkedIn: / prof-michael-mclaughlin

-

ABOUT EDSPIRA AND ITS CREATOR

* www.edspira.com/about/

* michaelmclaughlin.com

when I was in university, I watched Michael's videos. Now I am on my CPA path and I come back without any hesitation. Thank you Michael!!!!

These are by far the best accounting/finance videos on CZcams. They take all the dryness out of the subject, it's likes you're out with a friend having drinks and they are explaining it to you on a cocktail napkin.

Michael's videos are the most helpful accounting videos I had ever seen, Thank you for your years' devotion!

Happy to help!

my man "Money Mike" explaining this better in 6 minutes than any other professor's 3 hours lecture.

Thank you my friend!

So true.

reading the text makes it sound so overwhelming but these videos truly help to clarify and make it more usable information, thanks!

No problem! There is nothing more dry than reading an accounting textbook...

Saved hours of textbook reading by watching your video... thanks a million! With the basic understanding it will be much easier to understand the deeper concepts when reading additional study materials. Your channel is truly amazing!

My god you are a life saver! honestly the best accounting tutor on CZcams!!!

Day 2 of Accounting II. Your videos are gold. Thank you so much for these videos!

Always easy to follow, and the questions are always anticipated...well done!

Gosh, this helped me so much

thank u for explaining it shortly and precisely!

You are the best! LOVE your videos!!! Thank you so much!

Thank you for the kind words, you are awesome!

Thanks a lot sir...... your Videos are of great help....I am studying FAR right now, i always keep juggling between my own lecture videos and your videos....since your explanation is always simple and easy to understand

I'm studying for FAR right now. This is another great refresher!!!

I hope you ace the exam!

Thanks professor farhat for your help with your tutorials.

This was very helpful. I now understand how to apply the equity method when accounting for investment in associates. *chuckles* Thank you . :)

It really helped me to understand the concept. Thank You!

Protect this man at all cost

Thank you for bringing a smile to my face!

You saved my life. Thank you

This is great! Thank you!

Thank you Michael.

Great videos!

Love this channel! Thanks for the info

i like your videos but i wished it covered a little deeper. For instance, under the equity method, we should also account for asset differences adjustment and goodwill if applicable. Also, examiners trick people in areas where the investor initially owned less than 20% and later that year, the investor purchased more common stocks to bring his position to more than 20%.

Also an investor can own less than 20% in an an investee and still use equity method if such investor shows signs of exercising significant influence. Also you could clarify that in determining significant influence, preferred stocks are not used, common stocks only.

Excellent explanation.. Love it..

Your videos are SO helpful, thanks!

Awesome! Thanks for watching :)

thank you for making these videos! you're a huge help!!

No problem. Thanks for watching!

Very helpful. Thank you!

+3650days No problem. Have a nice winter break!

Thank you! {Pretoria, South Africa}

No problem!

This helped thanks so much

Thanks for the video

Amazing!!

Thanks!!

thank you

Thank you!

Happy to help!

Thank you

Great video!

Thanks!

Thanks bro!

God bless you

😀

helpful and quick. thanks!

You're welcome!

Your videos are a HUGEEEEEEEEE help...You know how to explain and how to make it easy for others to understand...pls post videos for spin-off, split-off. Thank you.

Sir i want to ask if we buy stock with equity method whether we must write the agio ( share premium ) or not or just buying price? Please answer i don't find a lot of sources of my question.

Thanks for this video! New to all this. Why are we getting a portion of this dividend being paid out to $10,000? What if that dividend was going to someone else? Does the 40% give us a claim to all dividends?

Any possibility of creating some videos showing other consolidation methods like for example investments in companies with a share over 50% or buying a complete company? Thanks ever so much.

I don't currently have any videos for these topics, but I plan to make videos on these topics in the next couple of months. Thanks so much for watching!

i cannot speak a very good english but i still understood it! thanks

May I ask accounting question regarding investment? when should I recognise investment in associates and subsidiaries? At the time of acquisition? Or issuance of share certificates? Or otherwise?

not sure if this is because of the change of text book, but my text book says different from your video: if the company reports a net income, you dr. equity in affiliate earnings instead of investment revenue. (not sure if I am correct about this either, just a concern)

When recording net income in the video, I debited Investment in Tom's Surf Shop and credited Investment Revenue. Investment in Tom's Surf Shop is an equity account. Thus, "equity in affiliate earnings" is another way of stating "Investment in affiliate", or Tom's Surf Shop in this instance. Great question!

Is there a video for consolidation method for investments ?

One suggestion that kindly enhance bold your handwriting....

Other things are good, nicely explain 👍

hi Michael, i saw your trading securities and available for sale ones. but any videos for Held to Maturity? just trying to understand how that works.

Yes. Below are links to the videos. Thanks for watching!

Amortize a Bond Discount: czcams.com/video/O2W935hzYpQ/video.html

Amortize a Bond Premium: czcams.com/video/meaqidbXHRY/video.html

Good day sir! When you received a dividend, why does it decreases your investment??

because the dividend payment decreases the retained earnings

Is 'Investment Revenue' a IS line item?

What happens if there is goodwill?

Why did you minus 4000? I thought that 4000 belonged to the Investor so therefore it would add 4000

thank you

No problem!