Dynamic Hedging Options - Make money if the stock moves either direction

Vložit

- čas přidán 2. 08. 2024

- Dynamic Hedging is a way to potentially make money if the stock moves down or massively takes off! It's super simple to execute and involves the shorting shares while simultaneously owning a long call. If the stock moves back and forth I make money off of the movement.

💰 Join the discord chat: / drawbridgefinance

📈 Download Spreadsheets: www.drawbridgefinance.ca

💰 All my links: www.linktr.ee/drawbridgefinance

▬ Discount to Seeking Alpha Only $99/annually ▬▬▬▬▬▬▬▬▬

►www.sahg6dtr.com/2RSPJ5/R74QP/

▬ BROKERAGES I USE ▬▬▬▬▬▬▬▬▬

►Interactive Brokers: www.interactivebrokers.com/mk... (Paid Link)

►Wealthsimple Trade for CANADIANS: Get $10 Free when you fund and trade $100 my.wealthsimple.com/app/publi...

▬ CONTENTS ▬▬▬▬▬▬▬▬▬▬

0:00 Intro into Dynamic Hedging

0:56 Download the Dynamic Hedging Record Keeper

1:39 Dynamic Hedging VS Straddle

2:48 Buying a Straddle in IBKR

3:29 Trading Checklist

5:29 Seeking Alpha Quant Rating

6:37 Entering a Dynamic Hedge in IBKR

8:47 Managing the Dynamic Hedge

9:26 How to record Trades

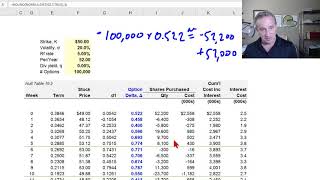

11:10 Calculate Position Delta

12:40 Risks of the Trade

13:05 Recording stock transactions

14:07 Daily Updates

17:40 Closing the Trade

▬ GREAT FINANCIAL BOOKS ▬▬▬▬▬▬▬▬▬

► Unlucky Investor’s Guide to Options Trading(Pre Order): amzn.to/3ETWQpa

► Think and Grow Rich: amzn.to/2t285sL

► The Wealthy Barber: amzn.to/2sW9XTM

► The Millionaire Next Door: amzn.to/2HB6DTk

► Rich Dad Poor Dad: amzn.to/2y5rD4S

► Getting Started in Options: amzn.to/2LEJzWe

► Smart Couples Finish Rich: amzn.to/2Eu1qgr

► The Automatic Millionaire: amzn.to/2HcC5KU

▬ Trading Computer ▬▬▬▬▬▬▬▬▬

► LG OLED 48” 4k TV/Monitor: amzn.to/31lJPH8

► Samsung 28” 4k Monitors: amzn.to/32QZL4r

► Startech USB - HDMI (3rd Monitor): amzn.to/3EMBiKX

▬ Cameras ▬▬▬▬▬▬▬▬▬

► My New Canon RP: amzn.to/3mQwkqf

► My New Canon 35mm Lens:amzn.to/3mRmg0d

► Canon 80D: amzn.to/2HxdGNL► Canon EF-S 18-135mm: amzn.to/2FhwsXd

► Canon EF 50mm: amzn.to/2UyB5HM

► Canon EF 100mm: amzn.to/2SnOjEG

► Canon EF-S 10-18mm (VLOG Lens): amzn.to/2HuQ6B4

▬ Live Stream Gear: Video ▬▬▬▬▬▬▬▬▬

► Atem Mini Pro: amzn.to/3zRhJjA

► Glide Gear Teleprompter: amzn.to/3FSYnNl

► Elgato Stream Deck XL: amzn.to/3FMYV7t

► Iphone Lightening HDMI Adapter: amzn.to/3qLoVKh

► Joby GorillaPod (Bendy Tripod): amzn.to/3JsQ5xQ

► Manfrotto Tripod with Video Head: amzn.to/3bi67tr

► Andoer GVM GP-80QD Slider: amzn.to/2qZtXUo

▬ Live Stream Gear: Audio ▬▬▬▬▬▬▬▬▬

► Rolls MicSwitch MS111: amzn.to/3sQI7Zv

► RODE VideoMic Pro: amzn.to/2vYqXOn

-- As an Amazon Associate I earn from qualifying purchases --

Subscribe to Drawbridge Finance on CZcams: czcams.com/users/Drawbridgef...

My primary investment strategy is long term high yield dividend investing, index funds and reducing risk and exposure using options. I have been actively trading the stock market for over 25 years and have built most of my wealth by reinvesting my dividends and following my 14 Personal Rules of investing. I actively trade options on both the American and Canadian Stock exchanges using options strategies and buying and holding high yield dividend paying stocks.

I generate monthly income in two ways. Averaging more than an annual 7% return by collecting dividends on high yield dividend stocks that I hold. The second income stream comes from the selling of option premium and taking advantage of theta decay. I love trading strangles, Iron condors and diagonal spread for maximizing returns. Delta neutral strategies allows me to make money in both bull and bear markets and limits my risk. Both of these strategies are suitable for passive income and create a stable predictable safe passive monthly income.

Want to learn how to trade stocks and make more money? This channel is dedicated to increasing investment returns and building wealth by passively trading in the stock market. If you’re tired of poor performance then make sure you subscribe to Drawbridge Finance czcams.com/users/Drawbridgef... I produce weekly videos for the beginner trader and use simple explanations to learn how I buy and sell stocks for profit.

Let’s Get Rich Together

Levi Woods

Disclaimer: I am not a financial planner and am not offering investment advice. This is an opinion channel only and should not be taken as any form of financial advice. I receive a small commission from the purchase of any item from using the links listed above. There are financial risks involved in taking on any monetary transaction that I discuss in my videos.

#optionstrading #stockmarket #LetsGetRichTogether

💰 Join the discord chat: www.patreon.com/drawbridgefinance

📈 Download Spreadsheets: www.drawbridgefinance.ca

💰 All my links: www.linktr.ee/drawbridgefinance

▬ 50% Discount to Seeking Alpha ▬▬▬▬▬▬▬▬▬

►www.sahg6dtr.com/2RSPJ5/2CTPL/?Sub1=ad

👀

How do you deal with news if you are into a hedge? Cause if there is an high impact news there will be a slippage on your entry..

The best video on dynamic hedging

Good video, well informed 📌

Brilliant !

Hi, thank You for this great video. Did You do it with Camtasia ? - or wich Software did You use - Greetings from Switzerland

Very interesting, can you provide a video with an example of a profitable trade using this strategy? Appreciated :)

Hi Levi,

Thanks for the excellent videos. I had a question about your patron I was considering. At the Option Traders Club level I understand we get notified of your option trades. Are those notifications at the end of the day or right after the trade executes? Thank you

Hi Michael, thanks for reaching out. When I make a trade, the trades notifications are posted to the discord chat room within a few minutes of a filled trade. Also there is a real-time spreadsheet sheet available to options tier members that shows all open option positions. Open trades that generate weekly cash flow or need adjustments often have the potential new positions entered into the sheet before the trade is executed.

Very good video. Clear and precise explanations. A question...Could the Excel table be used futures options ? Thank you

Yes, absolutely.

At 2:51, how do you get the "CHNG %" shown on your watch list?

selling ATM straddles is wild

What if the short stock starts falling in price and you buy but it still keeps falling (how will anyone time the bottom), won't you keep losing money on your long call?

Levi - Thanks for the great video on dynamic delta hedging. I purchased your spreadsheet and reconfigured it for excel. I use Marketxls to input live option data. It seems to me that you can also construct a similar hedge with a long put and a long stock position. This would allow use of this strategy in an IRA. I’m having a bit of trouble wrapping my head around the P/L from doing this. I know you have the gains/losses computed in the spreadsheet, but a lot of trades don’t seem a generate a great amount of P/L. Is this to be expected? Tx - Mark

Hey Mark, Sorry about my tardy reply. This shows in an usual place here on CZcams that I don't often check. Dynamic Hedges usually carry a cost and don't make money by themselves. I typically pair them with a short put, or a setup similar to an Iron Condor that makes money if the stock doesn't move. The dynamic hedges by themselves make most of the income to the downside and don't generate all that much on up moves. Hope that helps! Enjoy the rest of your weekend.

What is the software you use to edit your videos? Great job by the way !

I use Final Cut Pro X.

great explaination, could you help to clarify below 2 questions?

1. why dont you buy put + short stock? it donst require the interest fee for inital build up

2. how to choose the underlying stock with high volitality?

Buying puts and shorting stock are both bearish trades. I typically want to be neutral.

You can look at IV rank. This lets us know if the underlying is in a high range of its typical volatility.

Not totally clear from the video why the dynamic hedged position is superior to a naked straddle - is the rationale that it's a shorter distance for the stock to move to reach profitability, or that you get to stay in the position for an extended period while you wait for the stock to make a big move without much/any theta decay (relative to ths straddle)? Also, can you do a video where you walk through the paired condors? (are you using shorter durations for the counter-trade for example)

Trade makes money while moving back and forth rather than requiring a large move at all. Half the theta decay of a straddle. Yes shorter duration iron condors.

I am considering writing a put and going short the stock on the strike price. I believe the only way to lose in this scenario is if the price continues to fluctuate in and out of the strike price. Please let me know if you have any thoughts on this matter. Thank you!

If the stock rockets to the upside, you'll be in trouble. You're talking about the inverse of a Covered Call, which effectively is a Covered Put.

How do you get a CREDIT in this strategy ? You buy 3 x Call for a Debit and for selling Shares you don´t get an initial Credit . This Strategy is a DEBIT Strategy at the beginning.

I show the exact figures at 15:30 in the video. The net CREDIT to open the position is about $2800.

If I buy a call I have a debit to pay and if you go short in a physical stock at the same time you stay at zero plus commission, ist not possible to get a credit , from what the credit is coming in your trade? You can trade this also in Option Net explorer or any other tool, you never will get a credit . I don’t understand it what IB is showing there.

Can I use the sheets for trades where I buy stocks + long put?

Not this sheet. Check out my y “options journal” as it is great for tracking that type of trade.

@@DrawbridgeFinance Do you please have a video where there was a tutorial on how to work with the "option journal"? I can't find any. Thank you

I don’t have a video on that sheet but it’s very straightforward. Each row enters a new trade individually. Can be a stock purchase, dividend, or option. The entry and exit is recorded on each row. There is an annual summary sheet which shows the account growth weekly with a chart.

Do you still employ this strategy currently with your other strategies?

Yes but only on a few stocks.

you cant make money when the stock moves either side. because you neutralize delta already (its out of straddles profit logic) bcs when the stock moves either way you would have neutral delta. so you cant profit from the move of stock price. but its true you profit from selling high buying low. but can it cover the theta cost ? very limited profit seems on this strategy. it looks like selling straddle in mirror. it seems you have an idea thet if can volatility beats the time decay or time beats the volatility.

The strategy alone it is not profitable most of the time if you use just one stock. This technique is used by large investors or market makers to reduce the risk in multiple basket of asset. At this point it is better to use a Straddle strategy to avoid high commission costs.

Long straddle? The vix is very low so that makes tons of sense.

@@DrawbridgeFinancestraddle has to be pre-filtered with a trend indicator like ADX or the ImpliedVolatility itself

Why would one need a patreon if you're a trading guru?

I started it because I had so many requests to see my exact trades and I thought it was reasonable to request that I get paid for my time to post trades and discuss the process. It has evolved from there to be more than a full time job to run the chat room. I help a considerable amount of people and a private group allows for me to focus on those individuals who are serious about learning and increasing their knowledge within a moderated community. I’ve run completely free groups before and they get out of hand quickly. Also the income generated from my patrons allows me a bit of freedom to spend money to continue to improve services. As you probably know, video creation is a time consuming endeavour and I would love to eventually have some help so that I can improve my content.

It seems their is no profit to this strategy.

First