Video není dostupné.

Omlouváme se.

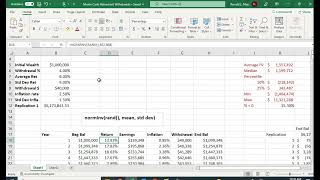

Monte Carlo Simulation in Excel - Capital Budgeting

Sdílet

Vložit

Velikost videa:

- čas přidán 15. 06. 2022

- More videos at facpub.stjohns...

Komentáře • 10

Další v pořadí

Automatické přehrávání

Monte Carlo Simulation in Excel - Retirement SavingsRonald Moy, Ph.D., CFA, CFP

zhlédnutí 38K

Monte Carlo Simulation Retirement WithdrawalsRonald Moy, Ph.D., CFA, CFP

zhlédnutí 11K

What is Monte Carlo Simulation?IBM Technology

zhlédnutí 252K

Comfortable 🤣 #comedy #funnyMicky Makeover

zhlédnutí 16M

لااا! هذه البرتقالة مزعجة جدًا #قصيرOne More Arabic

zhlédnutí 50M

GAME OF O.U.T. vs MINI CELINE 🙈⚽️Celine Dept

zhlédnutí 28M

Insane Coffee trick EXPOSED 😱☕️ #shortsWian

zhlédnutí 5M

Monte Carlo Simulations in Excel without 3rd Party Add-insAdventures in CRE

zhlédnutí 57K

Capital Budgeting Techniques in English - NPV, IRR , Payback Period and PI, accountingpmtycoon

zhlédnutí 1,4M

Monte Carlo Method: Value at Risk (VaR) In ExcelRyan O'Connell, CFA, FRM

zhlédnutí 46K

Monte Carlo SimulationMarbleScience

zhlédnutí 1,4M

Monte Carlo Simulation Retirement Withdrawals in Google SheetsRonald Moy, Ph.D., CFA, CFP

zhlédnutí 2K

Monte Carlo Simulation ExplainedScrum.org

zhlédnutí 25K

Master Capital Budgeting with Excel Now : A Step-by-Step Walkthrough.pmtycoon

zhlédnutí 20K

5 Excel Secrets You'll Be Embarrassed You Didn't KnowExcel Campus - Jon

zhlédnutí 151K

Monte Carlo Simulation For Any Model in Excel - A Step-by-Step GuideMinty Analyst

zhlédnutí 107K

VOLO VIA dallo staggio (elemento PROIBITO)😂🚀Sophialand

zhlédnutí 19M

Kundosaki - INSTAGRAM TĚ NEVYLÉČÍ, SURVIVOR MI POMOHL, TÝPCI JSOU MIMOVláďa Kadlec - EXPERIENCE

zhlédnutí 131K

Gyms in 2024☠️Noel Deyzel

zhlédnutí 18M

Secrets of Sealing: How to Keep Water in a Bag Without Leaking. #survival #camping #lifehacksSergio Outdoors

zhlédnutí 7M

Survival Skills: Steam Distiller for Dirty Water in Extreme Conditions. #survival #campingSergio Outdoors

zhlédnutí 29M

ОБЯЗАТЕЛЬНО СОВЕРШАЙТЕ ДОБРО!❤❤❤Chapitosiki

zhlédnutí 27M

Replacing a valve on a full water tank! 🫣💦 - 🎥 the_ladyplumberUNILAD

zhlédnutí 128M

This is the Biggest SAW in the World 😱🪚 #camping #survival #bushcraft #outdoors #lifehackMarusya Outdoors

zhlédnutí 18M

Thank you. I suggest that the more significant benefit would arise from simulating the interaction of several distributions rather than simulating a single distribution, which inherently gravitates towards the mean by definition.

Thank you for taking the time to explain this Dr. Moy

🎯 Key Takeaways for quick navigation:

00:00 🤖 *Introduction to Monte Carlo Simulation in Excel for Capital Budgeting*

- Understanding Monte Carlo Simulation for handling uncertainty in capital budgeting.

01:09 📈 *Normal Distribution and Cash Flow Variability*

- Explaining the properties of a normal distribution and how cash flows can vary.

03:12 📊 *Traditional NPV and IRR Calculation*

- Demonstrating the standard NPV and IRR calculation methods for capital budgeting.

05:36 🎲 *Setting Up Monte Carlo Simulation*

- Using the NORM.INV function and random probabilities to simulate variable cash flows.

07:00 📉 *Monte Carlo NPV Calculation*

- Calculating NPV using the Monte Carlo simulation approach.

08:18 📈 *Monte Carlo IRR Calculation*

- Calculating IRR using the Monte Carlo simulation approach.

09:46 🔄 *Replicating Monte Carlo Simulations*

- Setting up multiple replications of the Monte Carlo simulation.

11:11 📈 *Analyzing Simulation Results*

- Calculating mean, median, maximum, and minimum values to assess project risk.

14:35 🔄 *Changing Standard Deviation*

- Illustrating the impact of changing the standard deviation on simulation results.

Made with HARPA AI

This was really good..great job Dr. Ronald Moy. I enjoyed this.

I see that you add c5 to the npv but it should be c4, as that is the project cost instead of the yearly cashflow.

very informative thank you!

kak cara hitung expected returnnya gmn?

thank you

Hi thanks for the video. I am just curious how do you determine the standard deviation for the assumptions?

If you have some historical data, you can estimate the standard deviation and use that.