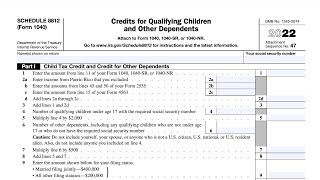

How to Fill Out The Child Tax Credit Schedule (Schedule 8812)

Vložit

- čas přidán 7. 09. 2024

- In this video I discuss how to fill out out the child tax credit schedule, Schedule 8812 on the Form 1040. I discuss the 3,600 and 3,000 child tax credit amounts and also briefly go over advance child tax credit info.

THIS WAS SO HELPFUL! I was lost on doing this form, until I watched your video. You walked me through it so easily. THANK YOU THANK YOU THANK YOU!

Glad it helped!

Thank you, I flipped the subtraction on line nine and couldn't for the life of me see it until this very helpful example.

Glad it helped!

thank you! I needed to understand this for my Tax Class! you made it possible

Huge thank you! You helped me identify my error easily … saving me $50 in Turbo Tax fees … much appreciated!!

Glad the video helped!

Thank you. I'm taking accounting courses, including federal taxes and I was struggling with this concept until I watched your video.

Thank you so much for the thorough explanation. I watched others but yours was the easiest to understand and follow along.

Glad you found the video helpful!

Pp

@@TaxTeach How do Complete the form when I only have 1 child who is under 6, when i process it keep saying zero?

The 8812 form for 2022 has changed. Can you please make an updated video? Thank you!

Thank you so much! I made an error, but couldn't figure where I went wrong. By watching your video I found where I made the error and also was confident that I filled it out correct!!

Glad to hear that you found the video helpful!

Thank you so much for line by line explanation.

Glad you found the video helpful!

I agree with all these lovely people! Thank You!

Thank you so much for this resource!

Glad you enjoyed the video!

thx you don't cloud the issues. You are honest

Glad you found the video helpful!

Thank you so so much! I am/ was was having a hard time completing my 1040 ....

****I NEED TI ADD A NEW BABY, born March 2020 .... I pray that this works ( Me doing the FreeFillableForms , becsuse I have 8 children, my car broke down permanently, and this will be a life saver!

Violet- you are probably eligible to use the free tax usa program which auto calculate for you

Thank you for explaining this !

Glad it was helpful!

Thank u so much!!!!!!! This video was extremely helpful!

Thank you!

Thank you for the explanation. I'm using the IRS Free File and I've followed the instructions to the letter; however, my return keeps getting rejected. The error and solution are as follows:

BUSINESS RULE IND-460

Error

Schedule 8812 is missing data.

Solution

When the boxes on line 13 of Schedule 8812 are checked, Part I-B, must be completed.

Enter your worksheet amount on line 14c and complete Part I-B.

The amounts on Form 1040, line 19 and Schedule 8812, line 14g must match.

I've checked the box on line 13, completed Part 1-B, and ensured that Form 1040, Line 19 and Schedule 8812, line 14g match.

It seems like the logic or XML in one of the forms is broken. Can you offer any recommendations? Thanks!

ANY UPDATE??? Did you receive your refund/ 2nd half of the Child Tax Credit yet?

I'm also using the free filers form 2021 , In order to get the Child Tax Credit ...My family literally depends on it at this point :( . Im having a hard time doing the free filers ( the last time was much easier) ..

*** I HAD A BABY IN MARCH 2020, and I need to add her as well.

*ANY ADVICE??? Other then this video ( though it's very good)?

Im overwhelmed :( & I can't pay a tax pro ....

Thank you, you save us 1600 dollars!!!!

What about other dependants? No one seems to make videos explaining that I'm claiming adult's and head of household?

You’re Awesome!

Question- I followed your video it seems the amount of line 14g $4,600 here should go to from 1040 line 19 as child tax credit. However on 8812 it only says 14h ($0 here) goes to 1040 line 19. 14i (same amount as 14g) goes to 1040 line 28. So confused. What line on 8812 should goes to 1040 line 19?

Can you show how Part I-C works?

I don’t have a form 1040

For the first line is that number from the W2 form line 1??????

i am talking about line 9 on the Line 5 worksheet

where did you get this form? I have looked everywhere in the Internet but I couldn't find it?

Hi, is there a maximum amount/cap that one can receive for child tax credit? For example people that have 5+ children?

Is there a video for filling out the actc?

hey can you please. i am stuck on line 9. in your example it said to subtract 112500-50000. That equals 62,500. So i do not understand how did you get 0 for line 9. please help maybe i didnt understand something and i need to get clarity.

anyway to confirm the amount if you are missing the 6419 letter?

How do you complete this through E-file?

What happened to part C? Thanks for the other parts.

Thanks man 🙏

Glad you found the video helpful!

Great video. My wife and I filled married jointly and we were expecting a small refund around $300 but then IRS made changes to our refund and said we owe around $1300. We did the math and found the IRS wanted to get back exactly the $1650 that we got for one of our kids last year in advance. We have two kids; 3 and 6 years old. Any clue why this happened. Tried to contact IRS but they are super busy.

I’m having same exact problem

Refund said $1125

Now I owe $525 I suppose they are charging $1650

I am on the phone with the irs (wait line) as I type this comment.

Hi Waleed, I managed to get thru to the IRS and my problem was that I got the advance child tax credit payments, but never applied for the full credit somehow, so instead of getting $1800 of the $3600 credit in advance and then getting the rest later as a refund, I basically got $1800 that they now want back because I didn't claim the rest of the $3600. Maybe the same happened with you?

You didn't say anything about the other sections - if you only need the first page do you include pages 2 and 3

Do I have to complete the schedule 8812 for 2020 tax year if I didn't receive my credits from 2020? Or do I only have to fill out the 2021 in order to get both years refund? Thank you so much

If the mother claims her on her taxes, will I still qualify to get the tax credit from form 8812.

Thanks for great videos

Since the mother is claiming the child, the mother would be the one who would qualify to take the child tax credit for the child.

where do I find line 5 work sheet? do I send that in as well?

The line 5 work sheet can be found on page 4 of the Schedule 8812 instructions: www.irs.gov/pub/irs-pdf/i1040s8.pdf

You are not required to send in the line 5 worksheet to the IRS. I would keep that worksheet for your personal records.

nervermind i figured it out😀

Veronica, i have the same question what did you find? If he takes 112,500-50,000 = 62,500 so the way i'm reading this zero would not be entered it should be 63,000?

Is it off focus or just me.

Help!!! Both my kids are under 6, so schedule 8812 seems to calculate zero tax credit? Is this correct, or is there another way to claim the credit if all your kids are under 6?

I just went through this form and if you have two kids under 6 you should get $3,600 per kid for a total of $7200 unless you make over the limit for your filing status. Then they decrease the child refund amount but only in small increments. Unless your making a huge amount of money. Go through and check your form calculations better. They did give a Advance of the Child tax in 2021 but there will be a letter they sent that has the amount they paid for both kids. I only have one kid over 6 and they gave me $750 during 2021 and I had to subtract that from the total in line 14f. So instead of the $3000 I got $2,250 child tax credit.

@@basilyousif3077 can you help me here - which line on 8812 here goes to 1040 line 19 as child tax credit? I think it should be the amount on line 14g here, but it says 14h (should be $0 for most including me) goes to 1040 line 19. It’s so confused. Which line here goes to 1040 line 19 ?

@@juliajulia5230 In my case I got to 14i and that was my total after subtracting the Child tax credit they already paid me in 2021. The other parts would be filled out if you reside in Porto Reco or another section if you live in another country other than US - read through it and look at the instructions its straight forward.

Thanks so much

No problem, glad you found the video informative!

Thank you!

You're welcome!