- 75

- 613 462

Real Estate Finance Academy | Trevor Calton

United States

Registrace 14. 11. 2018

Real estate training for commercial real estate professionals, or anyone wanting to learn how to invest in commercial real estate and multifamily properties.

- Commercial Real Estate Courses

- Real Estate Investor Training

- Real Estate Finance Training

- Commercial Real Estate Agent & Broker Training

- Commercial Lender Training

Trevor Calton is a longtime industry veteran and Professor of Real Estate Finance & Investments, teaching commercial real estate classes and training professionals since 2005. His commercial real estate classes and real estate finance development program helps people at all levels develop a successful real estate investment strategy.

If you need commercial real estate education, a commercial real estate coach, or a real estate investment mentor, you’ve come to the right place.

realestatefinanceacademy.com/

- Commercial Real Estate Courses

- Real Estate Investor Training

- Real Estate Finance Training

- Commercial Real Estate Agent & Broker Training

- Commercial Lender Training

Trevor Calton is a longtime industry veteran and Professor of Real Estate Finance & Investments, teaching commercial real estate classes and training professionals since 2005. His commercial real estate classes and real estate finance development program helps people at all levels develop a successful real estate investment strategy.

If you need commercial real estate education, a commercial real estate coach, or a real estate investment mentor, you’ve come to the right place.

realestatefinanceacademy.com/

1031 Exchange | What You Need to Know

For more Training & Coaching: realestatefinanceacademy.com/

For Commercial Loans & Investments: evergreen.llc/

---

The 1031 exchange, is one of the most beneficial advantages to a real estate investor in terms of tax benefits. And it allows the investor to keep their capital invested throughout the lifetime of their investment career without having to take portions of it and pay capital gains taxes with it.

[00:00:00] Introduction to 1031 Exchange

[00:00:21] How 1031 Exchange Works

[00:02:09] Role of Qualified Intermediary in 1031 Exchange

[00:03:37] Key Components of 1031 Exchange

[00:04:16] Understanding 'Like-Kind' Property

[00:05:26] The Importance of Written Agreement

[00:06:19] Understanding the Timelines

[00:07:15] The Importance of Replacement Property Search

[00:07:52] Understanding 'Constructive Receipt' and 'Boot'

[00:08:26] Identifying Potential Replacement Properties

[00:09:06] Closing the Replacement Property Deal

[00:09:25] The Power of Repeating 1031 Exchange

real estate seminar

real estate finance and investments

commercial real estate classes

real estate investment seminar

real estate finance course

real estate investment analyst

real estate investment mentor

real estate workshop

commercial real estate coaching

commercial real estate mentor

real estate masterclass

real estate finance class

commercial real estate mentorship

property investor seminar

property investment seminar

real estate finance training

property investment training

real estate financing course

property investment masterclass

real estate investor seminar

property finance course

For Commercial Loans & Investments: evergreen.llc/

---

The 1031 exchange, is one of the most beneficial advantages to a real estate investor in terms of tax benefits. And it allows the investor to keep their capital invested throughout the lifetime of their investment career without having to take portions of it and pay capital gains taxes with it.

[00:00:00] Introduction to 1031 Exchange

[00:00:21] How 1031 Exchange Works

[00:02:09] Role of Qualified Intermediary in 1031 Exchange

[00:03:37] Key Components of 1031 Exchange

[00:04:16] Understanding 'Like-Kind' Property

[00:05:26] The Importance of Written Agreement

[00:06:19] Understanding the Timelines

[00:07:15] The Importance of Replacement Property Search

[00:07:52] Understanding 'Constructive Receipt' and 'Boot'

[00:08:26] Identifying Potential Replacement Properties

[00:09:06] Closing the Replacement Property Deal

[00:09:25] The Power of Repeating 1031 Exchange

real estate seminar

real estate finance and investments

commercial real estate classes

real estate investment seminar

real estate finance course

real estate investment analyst

real estate investment mentor

real estate workshop

commercial real estate coaching

commercial real estate mentor

real estate masterclass

real estate finance class

commercial real estate mentorship

property investor seminar

property investment seminar

real estate finance training

property investment training

real estate financing course

property investment masterclass

real estate investor seminar

property finance course

zhlédnutí: 3 353

Video

How to Calculate Your Interest Rate on Any Loan or Credit Card

zhlédnutí 2KPřed 4 měsíci

For more Training & Coaching: realestatefinanceacademy.com/ For Commercial Loans & Investments: evergreen.llc/ How to EASILY CALCULATE YOUR INTEREST RATE on any loan or credit card, in just a few steps. In this video, you'll learn how to calculate home loan interest rate, or how to calculate loan interest per month on any loan or credit card. 00:17 - STEP 1: Understand the Balance and Interest ...

13 Myths About Commercial Loans

zhlédnutí 739Před 4 měsíci

How to Prepare a Perfect Multifamily Loan Application: learn.realestatefinanceacademy.com/offers/X52NKEyP For more courses & coaching, visit www.realestatefinanceacademy.com For Commercial Loans & Investments, visit : evergreen.llc/ Busting the 13 most Common Myths About Commercial Loans In this video, I dispel some of the most common myths about commercial loans, including misconceptions such ...

The Real Estate Finance and Investment Matrix

zhlédnutí 3,4KPřed 7 měsíci

For COURSES & COACHING, visit www.realestatefinanceacademy.com For COMMERCIAL LOANS, visit evergreen.llc Real Estate Financing and Investments Comprehensive Crash Course In this video, Trevor guides you through the roadmap to thoroughly understanding real estate financing and investments, how to calculate rental property cash flow, and how to calculate your investment returns. If you’re looking...

How to Calculate Internal Rate of Return “IRR”

zhlédnutí 16KPřed rokem

Learn REAL ESTATE FINANCE & INVESTMENTS at realestatefinanceacademy.com/ For COMMERCIAL LOANS, visit www.evergreen.llc [00:00:50] Definition of IRR [00:01:27] Example #1 [00:01:50] Calculating IRR with a Financial Calculator [00:03:14] Calculating IRR with a Spreadsheet [00:03:40] Example #2 [00:05:10] How IRR and NPV Are Related This video will explain when we are solving for "i" in our financ...

Freddie Mac Commercial Multifamily Loans | Overview

zhlédnutí 3KPřed rokem

For COMMERCIAL LOANS, visit www.evergreen.llc For COURSES & COACHING, visit www.realestatefinanceacademy.com Freddie Mac Small Balance Loan (SBL) Overview [00:00:41] Loan Amounts Up to $7.5 million [00:00:58] Up to 100 Units (or more) [00:01:16] Loan Purpose [00:01:28] Property Types [00:01:49] Interest-Only Options Available [00:02:09] 30-Year Amortization [00:02:33] Loan Term [00:02:49] Prepa...

HUD Commercial Multifamily Loans | What You Need to Know About HUD 223(f) Loan in 2024

zhlédnutí 3,3KPřed rokem

For HUD and other COMMERCIAL LOANS, visit www.evergreen.llc For COURSES & COACHING, visit www.realestatefinanceacademy.com HUD 223f Loan - Update 2024 The HUD 223(f) Multifamily Loan has distinct advantages compared to any other commercial loan on the market. But the parameters are a bit complex. MINIMUM LOAN SIZE is typically - $5 million ADVANTAGES: High Loan-to-Value Ratios Borrowers are all...

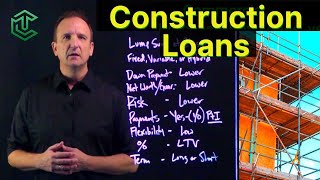

Construction Loans Explained

zhlédnutí 3KPřed rokem

For COURSES & COACHING, visit www.realestatefinanceacademy.com For COMMERCIAL LOANS, visit www.evergreen.llc In this video, we're talking about construction loans or more specifically the main differences between conventional purchase and refinance loans and construction or renovation loans. The qualifications are different, the requirements are different, and it's much more difficult to get a ...

Prepayment Penalties - Step Down, Yield Maintenance, and Defeasance Explained

zhlédnutí 3KPřed rokem

For COURSES & COACHING, visit www.realestatefinanceacademy.com For COMMERCIAL LOANS, visit www.evergreen.llc Understanding Prepayment Penalties on Commercial Loans: A Detailed Guide In this highly informative video, Trevor shares crucial insights into the three types of prepayment penalties - Step-down Prepayment Penalty, Yield Maintenance, and Defeasance - found in commercial loans. He provide...

4 Rules for Investing in Real Estate

zhlédnutí 1,6KPřed rokem

For COURSES & COACHING, visit www.realestatefinanceacademy.com For COMMERCIAL LOANS, visit www.evergreen.llc 4 Rules for Investing in Real Estate [00:00:00] Bigger is Better than Smaller With bigger deals, you build more wealth, you get economies of scale, you lower your overall transaction costs, and typically lower your cost of funds as well. [00:00:12] Sooner is Better than Later Time increa...

Tranches & Mortgage Backed Securities Explained

zhlédnutí 5KPřed rokem

For COURSES & COACHING, visit www.realestatefinanceacademy.com For COMMERCIAL LOANS, visit www.evergreen.llc Understand Mortgage-Backed Securities [00:00:00] Debt Funds and Loan Pools I find outside investors to invest their money into this fund and then I go out and loan it. So I've got a hundred million dollars worth of loans out there that are all paying somewhere between 8% and 10%. I had o...

ARM Loans - Adjustable Rate Mortgage Loan Terms Explained

zhlédnutí 2,1KPřed rokem

For COURSES & COACHING, visit www.realestatefinanceacademy.com For COMMERCIAL LOANS, visit www.evergreen.llc Adjustable Rate Loans: Terms & Provisions Explained This video explains the key components of Adjustable Rate Loans, and the various aspects such as adjustment intervals, teaser rates, different indices, margins, and composite rates. The video also clarifies concepts like reset dates, in...

How Leverage Impacts Your Return On Investment (ROI)

zhlédnutí 3,9KPřed rokem

For COURSES & COACHING, visit www.realestatefinanceacademy.com For COMMERCIAL LOANS, visit www.evergreen.llc [00:00:22] No Leverage. Return equals the Cap Rate [00:00:45] 50% Leverage [00:00:51] Loan Constant [00:01:18] 75% Leverage [00:02:04] Positive Leverage [00:02:45] Neutral Leverage [00:02:58] Negative Leverage [00:03:13] How to Optimize Leverage Leverage is the concept of using other peo...

Inheriting Real Estate - [Live Q&A] “I Inherited Real Estate and Don’t Know Where to Start!”

zhlédnutí 778Před 2 lety

Inheriting Real Estate - [Live Q&A] “I Inherited Real Estate and Don’t Know Where to Start!”

How to Turn Housemates Into House Hacking!

zhlédnutí 1,1KPřed 2 lety

How to Turn Housemates Into House Hacking!

How Real Estate Acts as a Hedge Against Inflation

zhlédnutí 1,6KPřed 2 lety

How Real Estate Acts as a Hedge Against Inflation

"Know Your Numbers" Crash Course in Financial Analysis of Investments

zhlédnutí 528Před 2 lety

"Know Your Numbers" Crash Course in Financial Analysis of Investments

Free Mini-Course Teaser: Cap Rates & How to Value Commercial Real Estate

zhlédnutí 157Před 2 lety

Free Mini-Course Teaser: Cap Rates & How to Value Commercial Real Estate

Mezzanine Debt & Weighted Average Cost of Capital

zhlédnutí 12KPřed 2 lety

Mezzanine Debt & Weighted Average Cost of Capital

Analyzing Self-Storage Investments: What You Need to Know

zhlédnutí 438Před 2 lety

Analyzing Self-Storage Investments: What You Need to Know

Chapter 3 Step-by-Step Solutions - Real Estate Finance & Investments - Brueggeman & Fisher Textbook

zhlédnutí 2,1KPřed 2 lety

Chapter 3 Step-by-Step Solutions - Real Estate Finance & Investments - Brueggeman & Fisher Textbook

Subordination and Lien Position Explained

zhlédnutí 3,8KPřed 2 lety

Subordination and Lien Position Explained

Steps to Buying a Commercial Investment Property

zhlédnutí 8KPřed 2 lety

Steps to Buying a Commercial Investment Property

Why Your Balance Goes UP After Making a Payment

zhlédnutí 5KPřed 2 lety

Why Your Balance Goes UP After Making a Payment

“Points” and Fees Explained | Understand Discount Points and Mortgage Loan Fees

zhlédnutí 3,4KPřed 2 lety

“Points” and Fees Explained | Understand Discount Points and Mortgage Loan Fees

C-PACE Funding for Commercial Real Estate

zhlédnutí 792Před 3 lety

C-PACE Funding for Commercial Real Estate

This is how to use the calculator--not how to calculate IRR.

If you want to actually learn it and know how to use it, take the free course. - Trevor learn.realestatefinanceacademy.com/finance-prerequisite

So I have a situation with this company called Fairstone. I make all my payments on time and they take their interest and the rest goes towards the principal. I’ve been making additional payments in between scheduled payments and I noticed they’re taking half of the additional payments towards interest. I thought anything additional would only go towards the principal to help pay down the interest in the long run.

thanks this helped me a lot

Glad it helped! Here’s the free course, if you want to learn more. - Trevor learn.realestatefinanceacademy.com/finance-prerequisite

net operating income is not fixed.

The point is that, as a buyer, you can apply a different Cap Rate, but the NOI is what it is. Hope that helps. - Trevor

Mr. Carlton I really appreciate you sharing your knowledge. I am watching through your videos in preparation for an opportunity a mentor is giving me and I think I am going to blow his socks off! I can’t thank you enough!

Thank you for the kind words. My pleasure! Happy to help! - Trevor

Give us an update on how it went!

You should definitely be teaching CCIM C101!!!

Thank you! - Trevor learn.realestatefinanceacademy.com/finance-prerequisite

How did he get the 599 montly payment?

You can learn how to do that in my free course here: learn.realestatefinanceacademy.com/finance-prerequisite - Trevor

Are you writing in mirror image? 😮

how to download the file last mentioned?

Link is at the top of the description: learn.realestatefinanceacademy.com/free-due-diligence-checklist-evergreen-capital

How did u reach the sum 599 at the start

You can learn how do that in my free course here: learn.realestatefinanceacademy.com/finance-prerequisite - Trevor

very helpful. . thanks man 👍🏻

You're an idiot if you're figuring out handwriting backwards listen to a loan explanation

Qualified intermediary. Ah, “government created jobs” because of government regulation driving up costs and leading to inflation.

I'm having a hard time understanding how you got $127 for the first year on monthly compound interest. Could you give a formula example please?

You can learn how to do that in my free course here: learn.realestatefinanceacademy.com/finance-prerequisite Hope that helps! - Trevor

I appreciate how clearly you explain things! Thanks!

You're very welcome! - Trevor

What’s a good GRM?

So the best thing to do is make some large principle payments and kick the amortization down the road and pay off your 30 years in under 10. Don't let the Banks rob you.

Impressed by this man's ability to write Deficiency from back to front

I’m 29 years old and never really understood how mortgage interest worked until watching this. Crazy that they don’t teach this stuff in school.

I am learning charting and retail trading so I can work remotely from home. What do you suggest would be good terms for an unsecured promissory note for a lender? I am looking into opening a margin account and need enough for a computer workstation and for the margin account and to cover payments payments on the note until I am profitable and can repay the note.

Can you do a video on what happens to the extra amount when you pay back more than the agreed $599.55 per month e.g. if you pay back $700 per month.

You can learn how to do that in my free course here: learn.realestatefinanceacademy.com/finance-prerequisite … OR if you just want the answer, grab the free spreadsheet in the description. Hope that helps! - Trevor

Where do you go to apply for the HUD 223(f) loan??

My team at Evergreen Capital can help. Feel free to contact me directly or visit evergreen.llc - Trevor

How can you calculate when it’s half interest and half principal

If you’re willing to invest 30-60 min. to learn, here’s the free course: learn.realestatefinanceacademy.com/finance-prerequisite

Thank you for making this so clear and simple!

Glad it was helpful! - Trevor

Great video. Thanks.

Glad you liked it! - Trevor

Can I get in contact with you

To the point! Great job!

I'd love to see that video about incremental borrowing.

Okay! Will do! Thanks for the comment. - Trevor

What if you get a seller that has 4 acres with an noi of 150k that’s wants to sell it for 5 or 6 million because he thinks that a developer will buy it

That’s not uncommon. I’ve had many clients do that. BUT for a 200-300% premium like that, the seller often needs to stay in the deal as a partner with the developer and share the risk, then get the big payout several years later. They almost never get the big price premium AND the cash up front. It’s usually one or the other. But every parcel is different, so there are many different factors to consider. - Trevor

@@RealEstateFinanceAcademy unfortunately, the seller doesn’t understand anything about noi or cap rates he’s 92 years old. He just thinks because he has 4 acres on a busy road he could get five or 6 million dollars he doesn’t understand that his retail strip center with very low rent all month to month brings down value of the property it’s not even on sewer

@gennerobootz6490 Yeah, the best thing you probably can do as an investor is to send him an unsolicited offer saying “If you change your mind and want cash today…” Unsophisticated, unmotivated owners are usually going to be a waste of time. A better use of YOUR time and money is to focus on motivated sellers who are ready to deal, especially in this market.

Great Video! On my credit statements, it indicates my purchase and cash advance rates.

Cash advances typically are charged the max interest rate. It’s a trap that credit card companies use. You may have to pay off the purchases before you get out of the cash advance rate. Check your credit card terms to be sure…. Hope that helps. - Trevor

@@RealEstateFinanceAcademy I see it as a tool. Capitalism as a system may also be viewd as a trap; however, we continue to use it. For certain populations in this society there have been and continue to be traps cash advance maybe just one of 1,000s for some. I use the cash advances on one specific card at a time with no additional purchases. Currently using Navy Federal at 18% interests for cash advances for which I been able to pay atlest $10,000-$15,000 dollars in credit card debt. In using this strategy, it still acts as a way of chunking payments onto my mortgages (1 of 3) until my $50,500 HELOC kicks in for use on debts. Great content and video really appreciate all you do to educate the people.

Awesome video

Thank you! 😊 - Trevor

Very informative. Thanks

Glad it was helpful! - Trevor

That really made it make sense to me. Now I'm trying to figure out if you're writing backwards 😮

Glad it was helpful! - Trevor

best explanation than it can ever be😊

Thank you. Glad you think so! - Trevor

Are we all going to ignore how perfectly he wrote backwards?!

Great video. I believe they don’t teach this in school, because it’s in their best interest for us to not know this.

Very true! Thank you for the nice words. - Trevor

Thank u sir so much as a banker it was much needed information

How do you calculate IRR if income per year is not constant?

It’s easiest to use the =IRR function on a spreadsheet when the cash flows are variable.

Dumb question: when we obtained a construction loan the interest reserve was added to it (around $35K I believe), is that interest now tacked onto (rolled over) to the mortgage loan once construction is done?

Not a dumb question at all! It depends on how it was structured. If you have a copy of your term sheet or promissory note, I can give you some guidance. If you like, you are welcome to me at info@evergreen.llc to set up a quick call and I can easily walk you through it. Depending on who is doing your perm loan, you may be able to negotiate away some of the fees. Happy to help. - Trevor

@@RealEstateFinanceAcademy will definitely send some info to your address you gave me, hopefully tonight. Thank you and I truly appreciate any/all advice!

Honeslty the most impressive thing about this is writing everything backwards like that

nobody in my school thought me this thank you uncle

First I was here to learn...but now Im wondering how he writes in inverted way to the camera...great presentation

How do you find out the original value of properties?

All real estate transactions are public record. Search title companies’ websites.

Thank you for this video, however, is there any way to find the 18th-month payment details without actually doing the 17 payment calculations?

Yes! It takes a few minutes to learn, but you can do that here: learn.realestatefinanceacademy.com/finance-prerequisite Hope that helps! - Trevor

I got sidetrack with trying to understand how you’re writing all that backwards 😂

Hey Trevor, thanks. Very informative. How can I find the tool you're using to write on this clear screen? I'm a flight instructor and would love to make videos like this

Hi! Thanks for the comment. I built that setup myself, but now there are pre-made lightboards that you can buy. Learning Glass is one but that’s all I know. Good luck! - Trevor

I want to make video teching like this , what tool of video relevent that you did?

I built this setup myself. :-)

Thank you so much you are truly helping me

Thank you for the note. Happy to know it’s helpful! - Trevor

Excellent Video thank you so much … 2-24-2024

I appreciate the kind words!

Trevor your videos are very easy to understand… Thank you and keep up the great work.

Glad you like them, Alex. Thanks for the note. - Trevor